In the ever-evolving world of forex trading, selecting a robust and reliable trading platform is paramount for traders at all experience levels. Tickmill, established in 2011, has risen to prominence within the forex community, offering an array of services designed to cater to both novice and professional traders. This article provides an in-depth analysis of Tickmill, exploring its advantages and limitations, and incorporating industry trends, user feedback, and statistical data to offer a balanced view.

Overview of Tickmill

Tickmill is a global forex and CFD broker regulated by some of the world's most stringent authorities, including the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Known for its competitive spreads and commitment to transparency, Tickmill provides traders with a platform that is both user-friendly and rich in features.

Key Features:

Regulation: Strong regulatory compliance ensures safety and transparency.

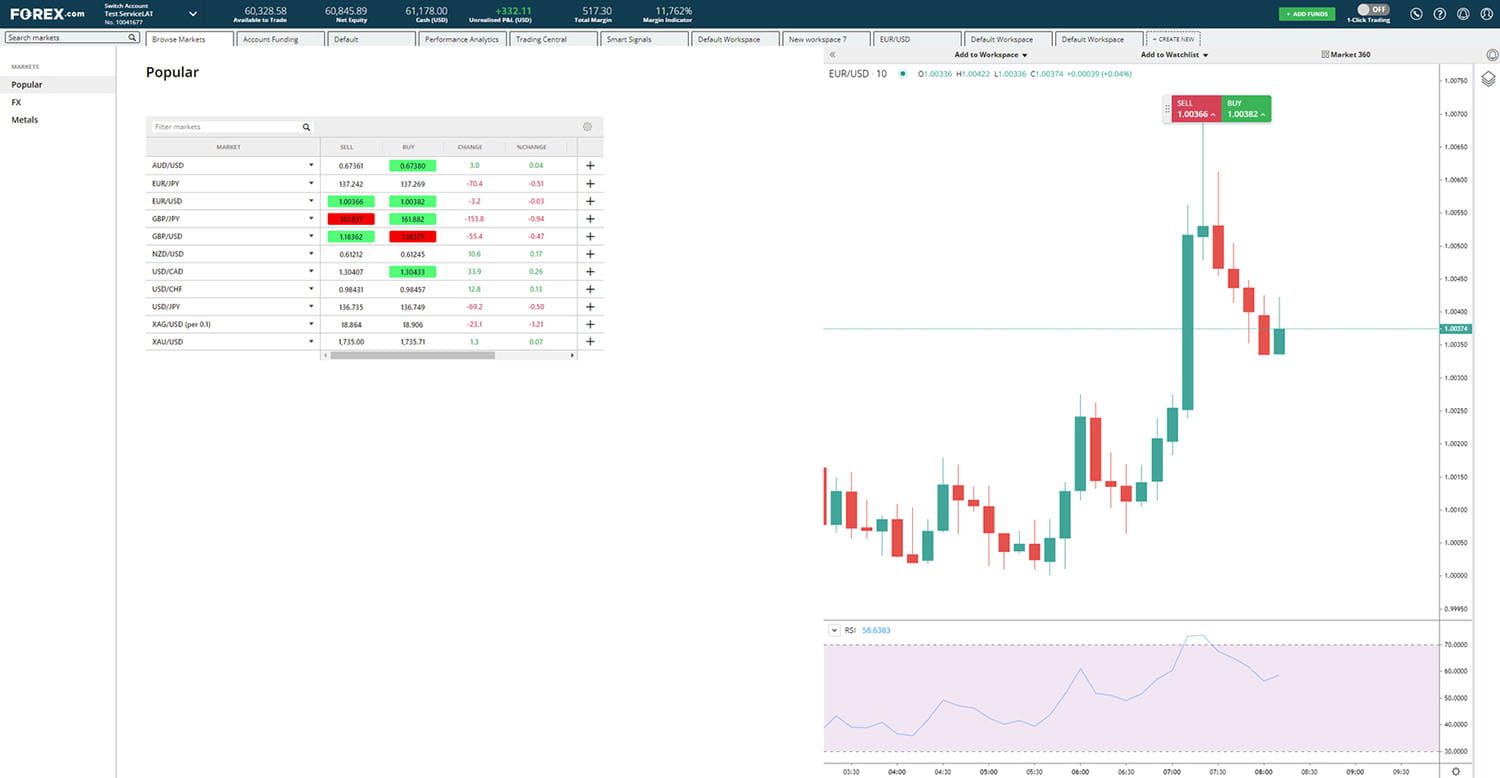

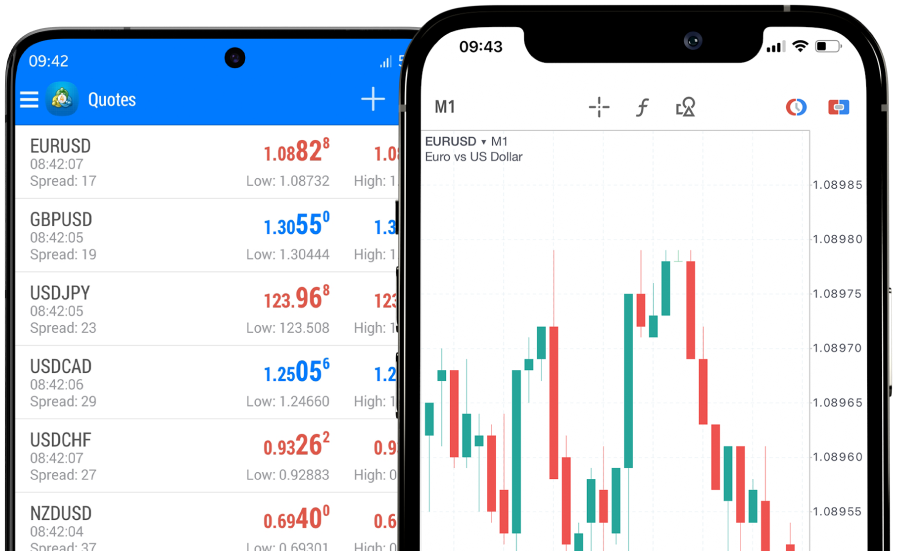

Platform Accessibility: Offers MetaTrader 4, known for its reliability and extensive tools.

Educational Resources: Comprehensive training materials and live webinars to support trader development.

Pros of Trading with Tickmill

1. Competitive Pricing:Tickmill stands out with some of the lowest spreads and commissions in the industry, making it an attractive choice for traders who value cost efficiency.

2. Advanced Trading Tools:Traders have access to a suite of advanced tools, including one-click trading, auto trading options, and detailed charting capabilities on the MT4 platform.

3. Strong Regulatory Framework:Tickmill’s adherence to FCA and CySEC regulations not only enhances its credibility but also provides a secure environment for traders' investments.

4. Exceptional Customer Support:Available in multiple languages, Tickmill’s customer service is highly responsive and knowledgeable, often receiving positive reviews from users for their professionalism and helpfulness.

Cons of Trading with Tickmill

1. Limited Platform Choices:While MetaTrader 4 is a powerful platform, some traders might prefer more variety or wish to trade on newer platforms like MetaTrader 5 or custom-developed trading software.

2. Restricted Product Portfolio:Compared to some competitors, Tickmill offers a relatively limited selection of trading instruments. While it covers major and minor forex pairs, commodities, and indices, it lacks cryptocurrencies and individual stocks.

3. Geographic Limitations:Certain traders, especially those from the U.S., are restricted from using Tickmill due to regulatory limitations, narrowing its global reach.

Industry Trends and How Tickmill Stands

The forex market is characterized by rapid technological advancements and increasing regulatory requirements. Tickmill has responded by integrating cutting-edge technology into its trading practices and maintaining up-to-date compliance with international financial standards. According to recent industry reports, Tickmill has managed to keep up with significant technological trends, such as implementing AI-driven tools for market analysis and risk management.

User Feedback:Feedback from various trading forums and review sites suggests that Tickmill is particularly favored for its user-centric approach and educational support. However, some users express a desire for more diverse asset options and additional trading platforms.

Conclusion

Tickmill offers a compelling mix of competitive trading conditions, robust regulatory safeguards, and a focus on customer service, making it a solid choice for forex traders in 2024. While there are areas where it could improve, such as expanding its asset offerings and platform options, the pros significantly outweigh the cons for most traders. As the forex market continues to evolve, Tickmill appears well-equipped to adapt and meet the changing needs of its users.

For further information on trading with Tickmill and to explore their educational resources, visit Tickmill's official website.