The Best Automated Forex Trading Software

Automated Forex trading software has become a cornerstone for many traders seeking efficiency, precision, and the ability to execute strategies without constant manual intervention. As the demand for these tools continues to grow, a myriad of options flood the market. In this article, we explore some of the best automated Forex trading software available, examining their features, advantages, and how they contribute to an enhanced trading experience.

1. MetaTrader 4 (MT4) and MetaTrader 5 (MT5):

1.1 Overview:

MetaTrader, developed by MetaQuotes Software, stands as one of the most popular platforms for Forex trading and automation. Both MT4 and MT5 support algorithmic trading through Expert Advisors (EAs), offering a vast array of features and tools.

1.2 Key Features:

MT4 and MT5 allow traders to develop and deploy custom EAs using the MQL4 and MQL5 programming languages. The platforms offer a user-friendly interface, advanced charting tools, and a diverse range of technical indicators for strategy development.

1.3 Advantages:

Widely adopted by traders globally, MetaTrader platforms benefit from a large community of developers. Traders can access a marketplace of pre-built EAs and indicators, facilitating the implementation of various trading strategies.

2. NinjaTrader:

2.1 Overview:

NinjaTrader is a comprehensive trading platform that supports algorithmic trading. Known for its advanced charting capabilities and strategy development tools, NinjaTrader is favored by traders looking for a robust and customizable solution.

2.2 Key Features:

NinjaTrader's NinjaScript allows traders to develop custom strategies and automated trading systems. The platform provides advanced analytics, a strategy analyzer for backtesting, and integration with external data feeds.

2.3 Advantages:

NinjaTrader stands out for its flexibility and scalability, making it suitable for both novice and experienced traders. The platform supports a variety of asset classes beyond Forex, expanding its appeal to traders across different markets.

3. cTrader and cAlgo:

3.1 Overview:

cTrader is a Forex trading platform that comes with an integrated algorithmic trading solution known as cAlgo. Developed by Spotware, cTrader is recognized for its intuitive interface and transparency in trade execution.

3.2 Key Features:

cAlgo provides a C#-based scripting language for developing automated trading strategies. Traders can create custom indicators, backtest their strategies, and access a range of pre-built algorithmic solutions.

3.3 Advantages:

cTrader's user-friendly design appeals to traders seeking simplicity without sacrificing functionality. The platform's algorithmic capabilities enhance its overall appeal for those looking to automate their Forex trading strategies.

4. TradingView:

4.1 Overview:

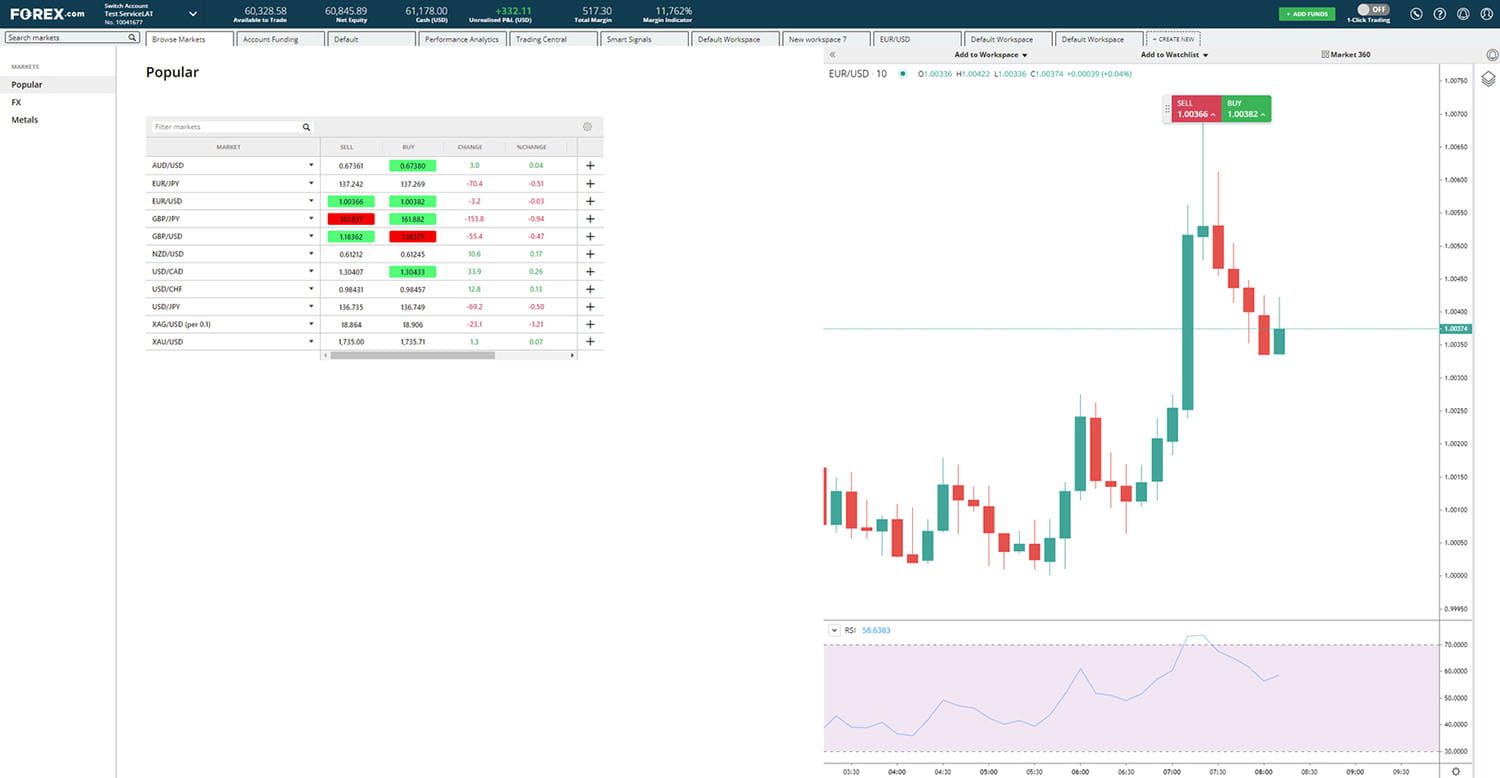

TradingView is a web-based platform known for its advanced charting tools and social trading features. While not a standalone automated trading platform, it integrates with various brokers and platforms to facilitate automated trading.

4.2 Key Features:

TradingView supports the Pine Script programming language, allowing traders to create custom indicators and strategies. The platform's social trading community enables users to share ideas and strategies.

4.3 Advantages:

TradingView's cloud-based nature provides accessibility across devices without the need for installations. Traders benefit from a vast library of community-contributed scripts and strategies.

5. Automated Forex Trading Robots:

5.1 Overview:

Automated Forex trading robots, or Expert Advisors, are software applications designed to trade on behalf of the user. These robots often integrate with popular trading platforms and execute trades based on predefined rules.

5.2 Key Features:

Forex robots vary in complexity, offering features such as trend analysis, scalping capabilities, and risk management. Some robots come with pre-configured settings, while others allow for customization based on individual preferences.

5.3 Advantages:

Automated Forex trading robots are suitable for traders who prefer a hands-off approach. They can operate 24/5, capturing opportunities in the Forex market even when the trader is not actively monitoring.

Conclusion:

The best automated Forex trading software depends on the trader's preferences, technical requirements, and desired features. Platforms like MetaTrader 4, MetaTrader 5, NinjaTrader, cTrader, and tools like TradingView and Forex robots offer diverse options to cater to the varied needs of traders. Regardless of the choice, incorporating automation can significantly enhance the efficiency and effectiveness of Forex trading strategies.