Forex Automation Software for Hands-Free Trading

In the dynamic realm of foreign exchange (Forex) trading, technological advancements have ushered in a new era of efficiency and convenience. Forex automation software, designed to execute trades automatically based on predefined criteria, has gained significant popularity among traders seeking hands-free and systematic trading approaches. In this article, we explore the world of Forex automation software, examining its features, advantages, considerations, and how it facilitates hands-free trading.

1. Understanding Forex Automation Software:

1.1 Definition:

Forex automation software, also known as Forex robots or Expert Advisors (EAs), is computer-based software designed to automate trading processes. These programs use algorithms and predefined rules to analyze market conditions and execute trades on behalf of the trader.

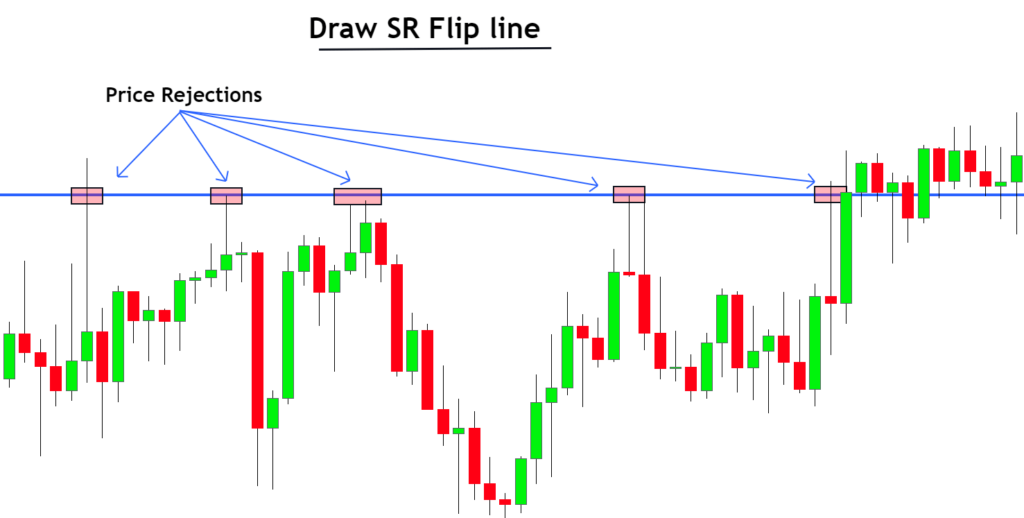

1.2 Algorithmic Trading Strategies:

Forex automation software employs algorithmic trading strategies, allowing traders to implement specific rules and conditions for entering and exiting trades. These strategies can be based on technical indicators, price patterns, or other quantitative parameters.

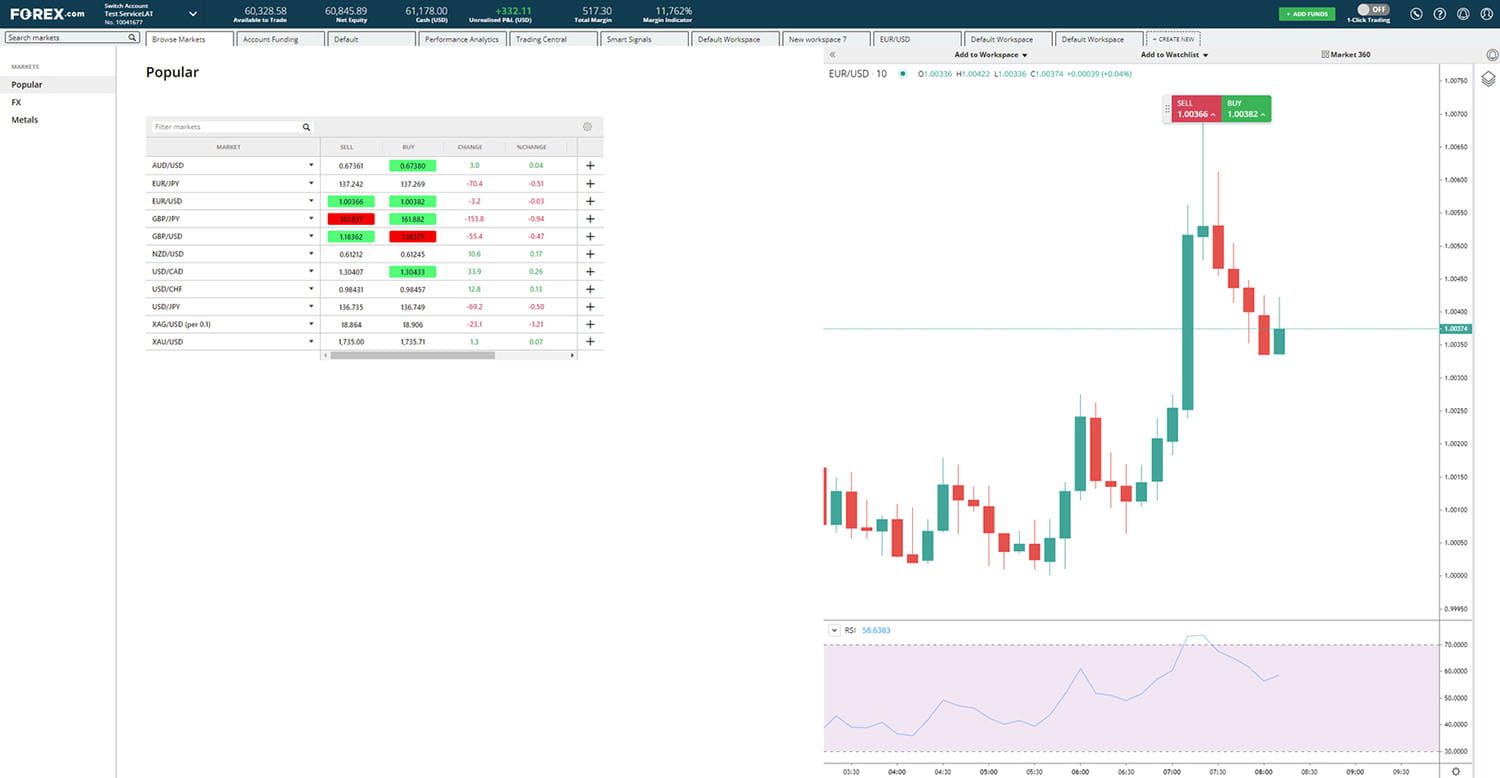

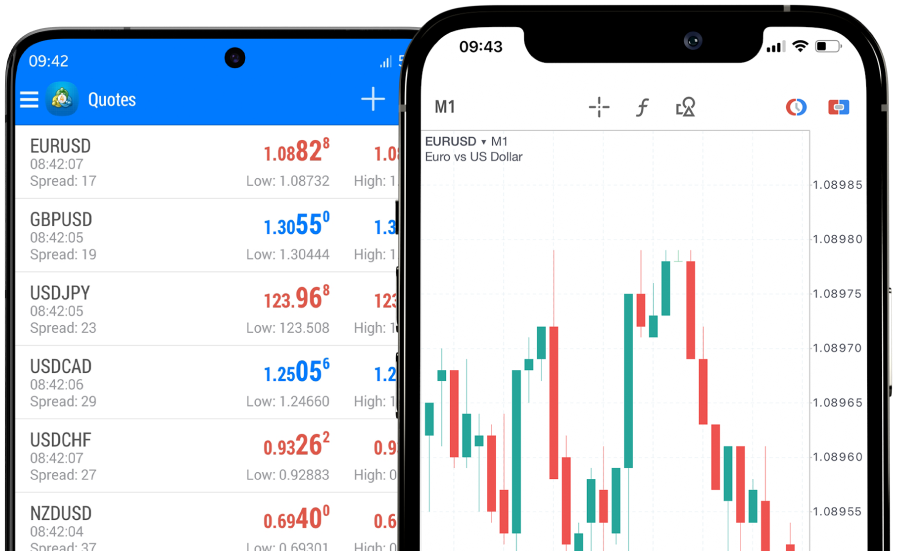

1.3 Integration with Trading Platforms:

Forex automation software is typically integrated with popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Traders can install these EAs on their trading platforms, enabling seamless automation of their chosen trading strategies.

2. Features and Advantages:

2.1 Hands-Free Trading:

The primary advantage of Forex automation software is hands-free trading. Traders can set up the software to execute trades automatically, reducing the need for constant monitoring and manual intervention.

2.2 Speed and Efficiency:

Automation enables rapid order execution, taking advantage of market opportunities at speeds beyond human capability. This speed is particularly crucial in the fast-paced Forex market, where timely execution can impact trading outcomes.

2.3 Backtesting Capabilities:

Forex automation software often comes with backtesting capabilities. Traders can test their strategies using historical data to evaluate performance and make informed decisions about strategy optimization.

2.4 Removal of Emotional Bias:

Automation eliminates emotional decision-making from the trading process. EAs operate based on predefined rules, reducing the impact of fear, greed, or other emotions that can influence manual trading decisions.

3. Considerations and Challenges:

3.1 Strategy Development:

Successful utilization of Forex automation software requires a well-defined trading strategy. Traders must carefully develop and optimize their strategies to ensure the software operates effectively in different market conditions.

3.2 Market Conditions and Adaptability:

While automation excels in executing predefined strategies, it may face challenges in adapting to unexpected market conditions. Traders should monitor their EAs and be prepared to intervene or adjust parameters as needed.

3.3 Risk Management:

Effective risk management remains a critical aspect of hands-free trading. Traders must configure their Forex automation software to incorporate risk management measures, such as setting stop-loss levels and position sizing, to protect their capital.

4. Popular Forex Automation Software:

4.1 MetaTrader 4 (MT4) and MetaTrader 5 (MT5):

MetaTrader platforms are widely used for Forex automation. Traders can create and install Expert Advisors on these platforms, benefiting from a vast community of developers and a range of built-in technical indicators.

4.2 NinjaTrader:

NinjaTrader is a comprehensive trading platform that supports algorithmic trading. Traders can develop and deploy automated strategies using NinjaScript, the platform's C#-based scripting language.

4.3 cAlgo:

cAlgo is a platform designed for algorithmic trading on the cTrader platform. Traders can use cAlgo to develop and automate trading strategies, taking advantage of the platform's user-friendly interface.

5. The Future of Forex Automation:

5.1 Machine Learning Integration:

The future of Forex automation may witness increased integration with machine learning techniques. Machine learning algorithms can adapt and evolve based on market data, potentially enhancing the adaptability and intelligence of Forex automation software.

5.2 Regulatory Considerations:

As automated trading continues to evolve, regulatory bodies may establish guidelines to ensure fair and transparent market practices. Traders should stay informed about any regulatory developments that may impact the use of Forex automation software.

Conclusion:

Forex automation software has transformed the landscape of currency trading, offering traders a hands-free approach to executing strategies with speed and efficiency. By understanding its features, leveraging its advantages, and addressing considerations and challenges, traders can harness the power of automation for enhanced trading experiences.