What is Automated Trading and How Does It Help You

Automated trading, also known as algorithmic trading or algo trading, has become a prevalent and transformative force in the financial markets. This method of executing trades using pre-programmed instructions has gained popularity due to its potential to enhance efficiency, reduce emotional decision-making, and capitalize on market opportunities. In this article, we delve into the intricacies of automated trading, exploring what it entails and how it can be a valuable tool for traders and investors.

1. Understanding Automated Trading:

1.1 Definition:

Automated trading involves the use of computer algorithms to execute trades in financial markets. These algorithms, often based on predefined rules and strategies, analyze market data, identify opportunities, and automatically place orders without the need for manual intervention.

1.2 Algorithmic Components:

Algorithms used in automated trading are composed of various components, including technical indicators, statistical models, and risk management parameters. These components work together to make trading decisions based on a set of rules programmed into the system.

1.3 Evolution of Technology:

The rise of automated trading can be attributed to advancements in technology, particularly in the fields of data analysis, computing power, and connectivity. High-frequency trading (HFT) is a subset of automated trading that leverages these technological advancements to execute a large number of orders at extremely high speeds.

2. How Automated Trading Works:

2.1 Market Analysis:

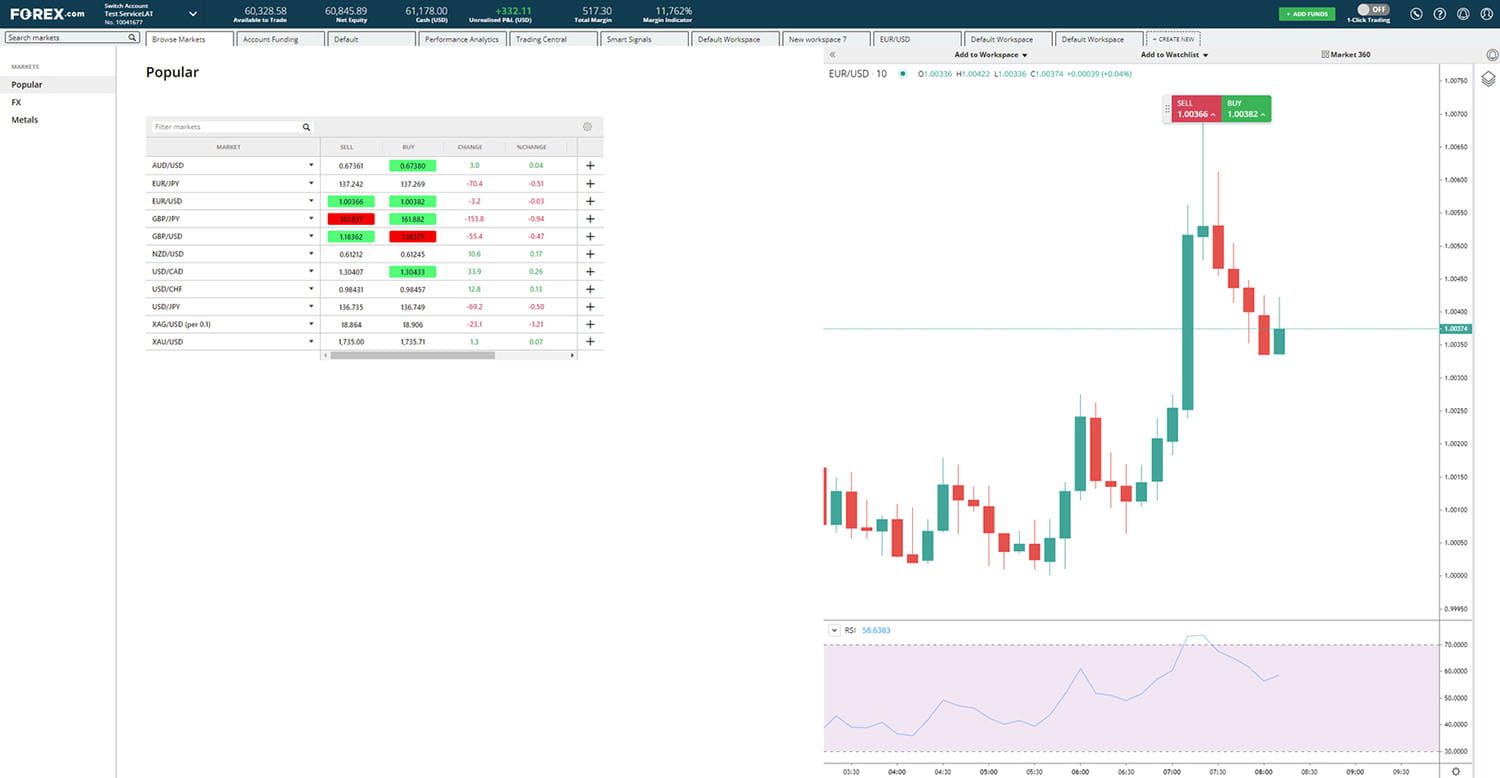

Automated trading systems analyze vast amounts of historical and real-time market data. This analysis includes price movements, trading volumes, and various technical indicators to identify potential trading opportunities.

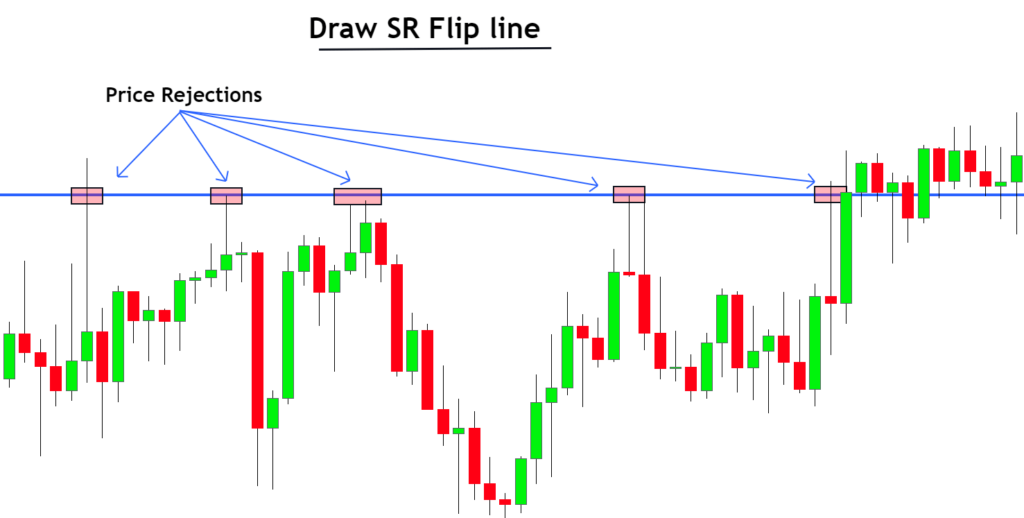

2.2 Rule-Based Decision Making:

Trading algorithms operate based on predefined rules and conditions. These rules can encompass various parameters, such as moving averages, price patterns, or mathematical models. The algorithm makes decisions to enter or exit trades when specific conditions are met.

2.3 Order Execution:

Once a trading opportunity is identified, the algorithm automatically generates and executes orders. The speed of execution is a key advantage of automated trading, especially in markets where milliseconds can make a significant difference.

2.4 Risk Management:

Automated trading systems incorporate risk management strategies to control potential losses. This includes setting stop-loss orders, position sizing based on account equity, and other measures to ensure responsible trading.

3. Advantages of Automated Trading:

3.1 Elimination of Emotional Bias:

One of the primary benefits of automated trading is the elimination of emotional decision-making. Trading based on predefined rules reduces the impact of fear, greed, or other emotional factors that can cloud judgment in manual trading.

3.2 Speed and Efficiency:

Automated trading systems can execute orders at speeds far beyond human capability. This speed is particularly advantageous in high-frequency trading, where milliseconds can impact the outcome of trades.

3.3 Backtesting and Optimization:

Automated trading allows traders to backtest their strategies using historical data. This process involves applying the algorithm to past market conditions to assess its performance. Traders can then optimize and refine their strategies based on the results.

3.4 Diversification:

Automated trading systems can simultaneously analyze multiple markets and instruments, enabling traders to diversify their portfolios. This diversification helps spread risk and capture opportunities in various financial instruments.

4. Considerations and Challenges:

4.1 System Monitoring:

While automated trading can operate independently, it requires ongoing monitoring. Traders should regularly check and update algorithms to ensure they remain effective in evolving market conditions.

4.2 Over-Optimization Risks:

Over-optimization occurs when a trading system is fine-tuned to historical data but fails to perform well in live market conditions. Traders should strike a balance between optimizing their algorithms and ensuring adaptability to changing markets.

4.3 Technical Challenges:

Automated trading is susceptible to technical issues, such as connectivity problems, system failures, or data inaccuracies. Traders must have contingency plans in place to address these challenges promptly.

5. The Future of Automated Trading:

5.1 Artificial Intelligence (AI) Integration:

The future of automated trading may see increased integration with artificial intelligence. Machine learning algorithms can adapt and evolve based on new data, potentially enhancing the adaptability and intelligence of trading systems.

5.2 Regulatory Considerations:

As automated trading continues to evolve, regulatory bodies are likely to scrutinize and establish guidelines to ensure fair and transparent market practices. Traders should stay informed about any regulatory developments that may impact automated trading strategies.

Conclusion:

Automated trading has revolutionized the financial markets, offering traders and investors a powerful tool to execute trades efficiently and systematically. By understanding the principles of automated trading, leveraging technological advancements, and addressing potential challenges, market participants can harness the benefits of this transformative approach to trading.