Best Forex Trading Signals and Strategies

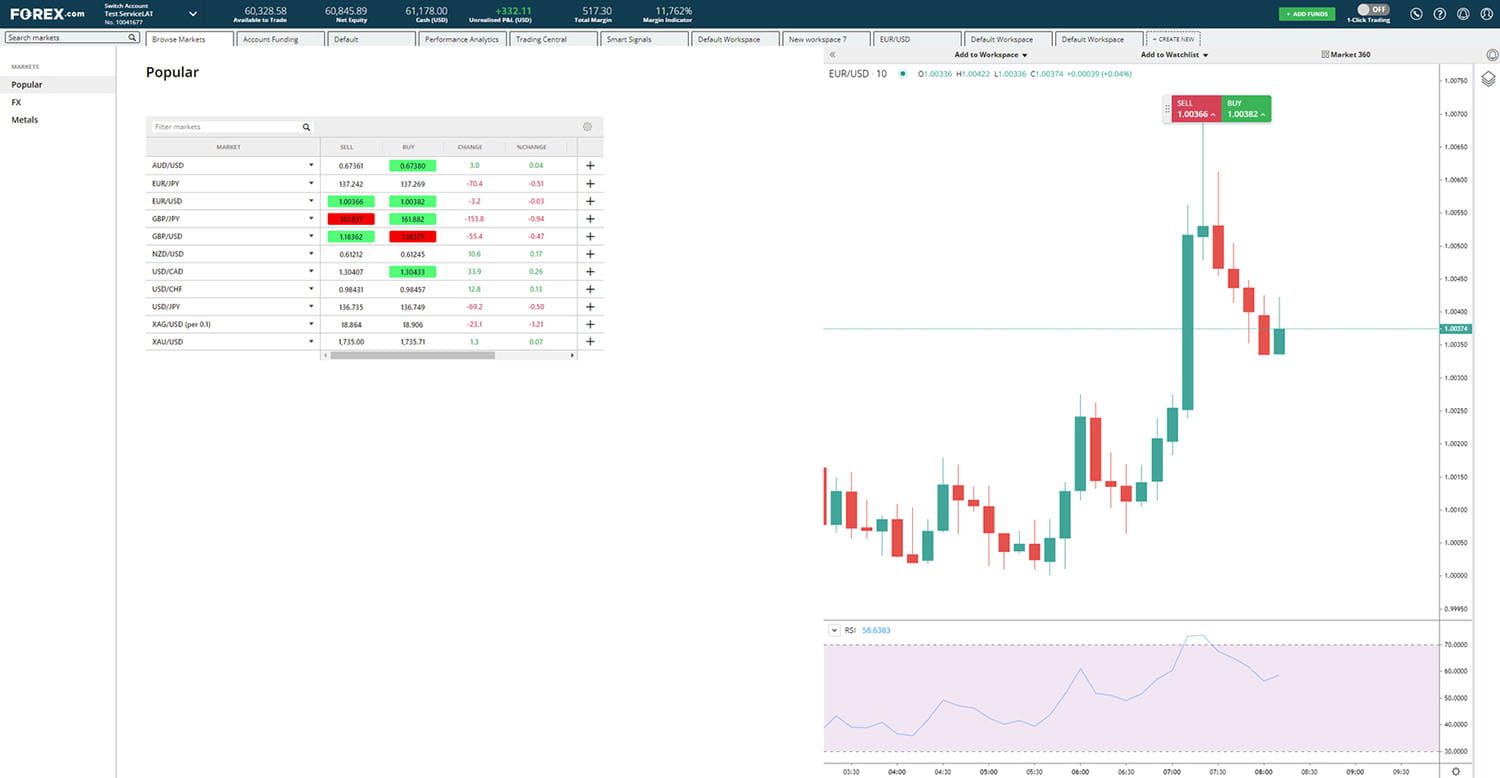

In the dynamic and highly competitive arena of Forex trading, success hinges on the ability to access accurate signals and deploy effective strategies. Traders are constantly seeking the optimal combination of signals and strategies to navigate the complexities of the market. In this article, we explore some of the best Forex trading signals and strategies that have proven to be effective in maximizing profits and managing risks.

Forex Trading Signals:

1. PipProfitsElite:

PipProfitsElite has gained recognition for its commitment to precision. The signals provided by this service are backed by thorough technical analysis, ensuring a high level of accuracy. Real-time updates and a user-friendly interface contribute to a seamless trading experience.

2. ForexMastersHub:

ForexMastersHub stands out for its holistic approach to trading signals. In addition to accurate buy and sell recommendations, the service offers in-depth market analysis and educational resources. This comprehensive approach caters to both novice and experienced traders.

3. PrecisionPips2024:

True to its name, PrecisionPips2024 excels in delivering high-precision signals. The service employs advanced algorithms and technical indicators to identify optimal entry and exit points. Traders seeking a meticulous approach to signal accuracy find PrecisionPips2024 to be a valuable resource.

4. MarketInsightsFX:

MarketInsightsFX combines signals with valuable insights into market trends. The service focuses on providing context to trading recommendations, empowering traders with a deeper understanding of market dynamics. This added layer of analysis contributes to more informed decision-making.

5. TradeMastersPro2024:

TradeMastersPro2024 is known for its consistency and reliability. The signals are well-researched and delivered with a strategic approach. The service maintains a transparent track record of performance, allowing traders to assess historical accuracy before subscribing.

Forex Trading Strategies:

1. Trend Following:

The trend-following strategy involves identifying and trading in the direction of the prevailing market trend. Traders using this strategy aim to capitalize on sustained price movements, entering long positions in uptrends and short positions in downtrends.

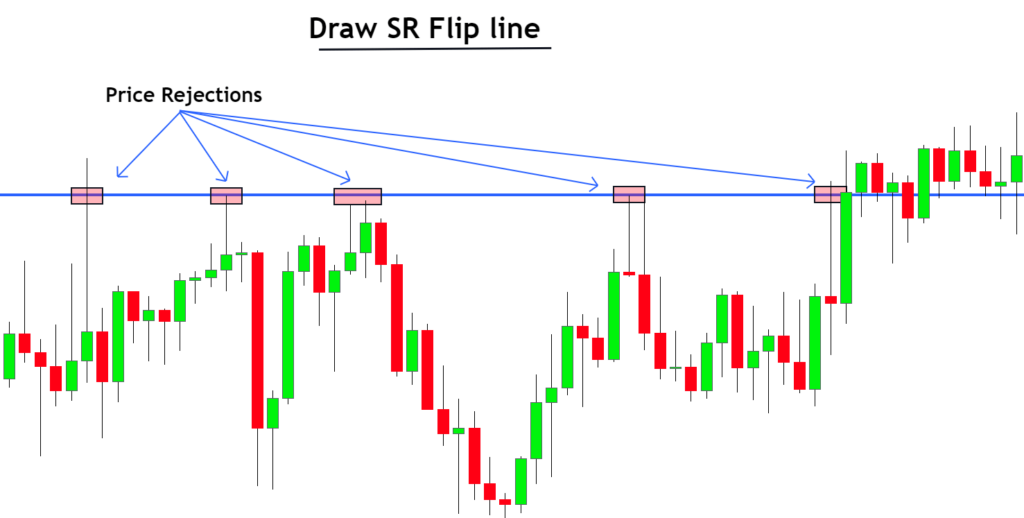

2. Breakout Trading:

Breakout trading involves entering a trade when the price breaks through a significant level of support or resistance. This strategy is based on the premise that a breakout could lead to a substantial price movement in the direction of the breakout.

3. Scalping:

Scalping is a short-term trading strategy that aims to capture small price movements. Traders employing scalping execute numerous trades in a single day, holding positions for only a few minutes to exploit minor fluctuations in currency prices.

4. Swing Trading:

Swing trading seeks to capture price "swings" or fluctuations in the market over a period of days to weeks. This strategy involves identifying key support and resistance levels and entering trades based on anticipated price reversals.

5. Range Trading:

Range trading involves identifying price ranges within which a currency pair fluctuates. Traders utilizing this strategy enter long positions near support levels and short positions near resistance levels, profiting from price movements within the established range.

Optimizing the Combination:

Successful Forex trading often lies in optimizing the combination of signals and strategies. Here are key considerations:

1. Alignment with Risk Tolerance:

Choose signals and strategies that align with your risk tolerance. Conservative traders may prefer strategies with lower risk profiles, while more aggressive traders may opt for higher-risk, higher-reward approaches.

2. Diversification:

Diversify your approach by combining signals and strategies that complement each other. A diversified portfolio of trading methods can help manage risk and adapt to varying market conditions.

3. Continuous Monitoring and Adaptation:

Markets evolve, and successful traders continuously monitor their signals and strategies. Be open to adapting your approach based on changing market dynamics and the performance of your chosen signals and strategies.

Conclusion:

Achieving success in Forex trading requires a judicious combination of the best signals and strategies. By leveraging accurate signals and deploying effective trading strategies, traders can navigate the challenges of the Forex market with confidence, aiming for consistent profitability.