How Do I Get Accurate Forex Signals

In the ever-evolving landscape of Forex trading, accurate signals can make the difference between profit and loss. Traders seek ways to gain a competitive edge in the market, and the quest for precision in trading signals is paramount. In this article, we explore the strategies and considerations for obtaining accurate Forex signals, empowering traders with the tools needed for success.

1. Utilize Reputable Signal Services:

One of the primary avenues for obtaining accurate Forex signals is through reputable signal services. These services employ experienced analysts and advanced algorithms to generate signals based on thorough market analysis. Traders should research and choose services with a proven track record of accuracy and reliability.

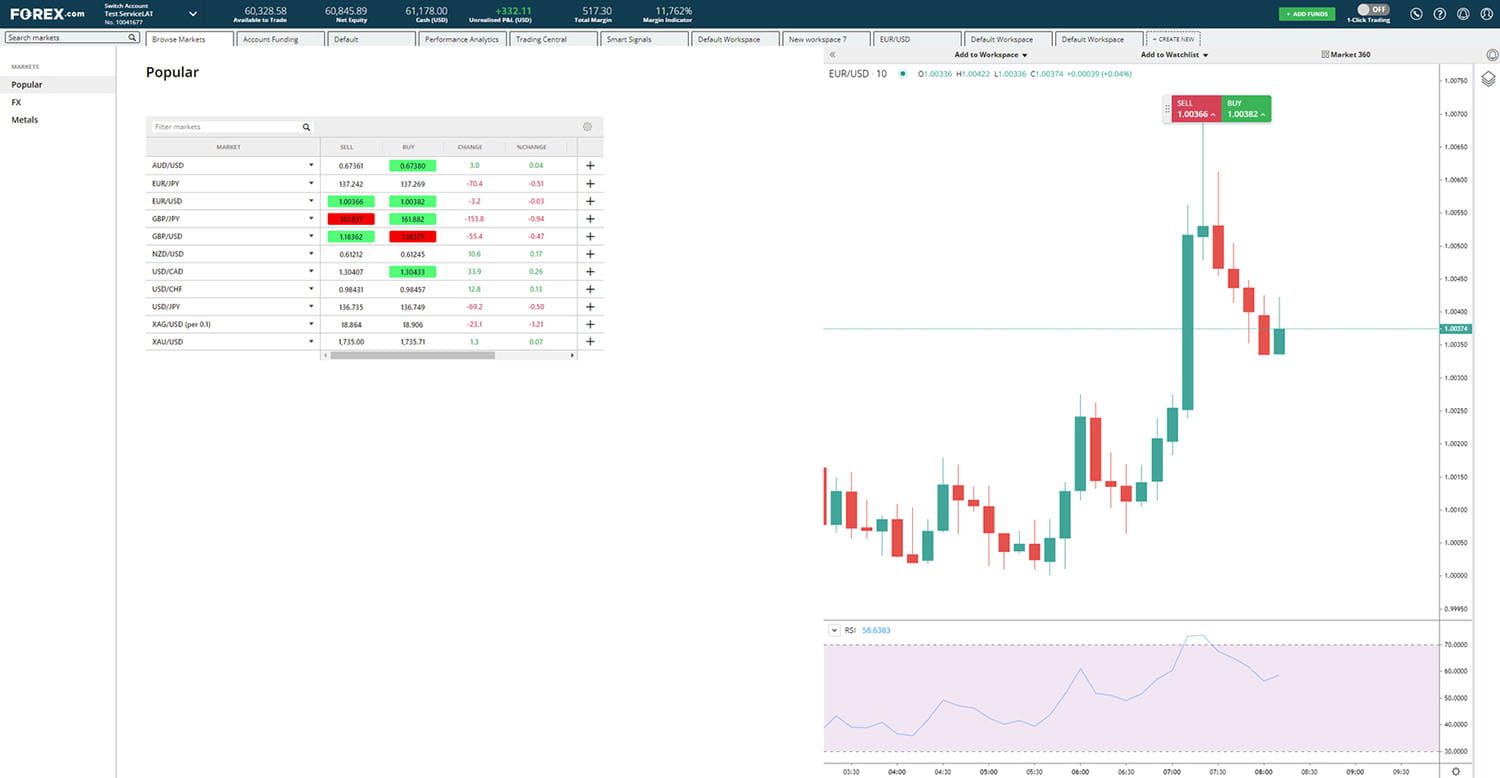

2. Leverage Technical Analysis:

Technical analysis plays a crucial role in generating accurate Forex signals. Traders can utilize various technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), to identify trends and potential entry and exit points. Mastering technical analysis enhances a trader's ability to interpret signals accurately.

3. Follow Economic Indicators and News Events:

Economic indicators and major news events can significantly impact currency movements. Monitoring economic calendars and staying abreast of key announcements allows traders to anticipate market shifts. Incorporating fundamental analysis into signal interpretation provides a more comprehensive view and contributes to accuracy.

4. Combine Multiple Timeframes:

Examining Forex signals across multiple timeframes can enhance accuracy. While short-term signals may be suitable for day trading, aligning them with signals from higher timeframes can provide confirmation and strengthen the overall trading decision. This approach reduces the impact of short-term market noise.

5. Implement Risk Management Strategies:

Accurate Forex signals should not only guide entry and exit points but also include risk management parameters. Traders should determine appropriate stop-loss and take-profit levels based on the signals provided. This ensures a disciplined approach to trading and helps safeguard against significant losses.

6. Backtesting Signals:

Backtesting historical data with the use of accurate Forex signals allows traders to assess the signals' performance under various market conditions. This empirical approach provides insights into the reliability of signals and aids in optimizing trading strategies for future use.

7. Understand Market Sentiment:

Market sentiment plays a crucial role in Forex movements. Traders can gauge sentiment through tools like the COT (Commitments of Traders) report and sentiment indicators. Aligning signals with the prevailing market sentiment enhances accuracy by identifying potential shifts in market direction.

8. Participate in Trading Communities:

Engaging with trading communities and forums can provide access to valuable insights and shared experiences. Traders often discuss signal providers, strategies, and market analysis, contributing to a collective pool of knowledge. This community interaction can help verify the accuracy of signals.

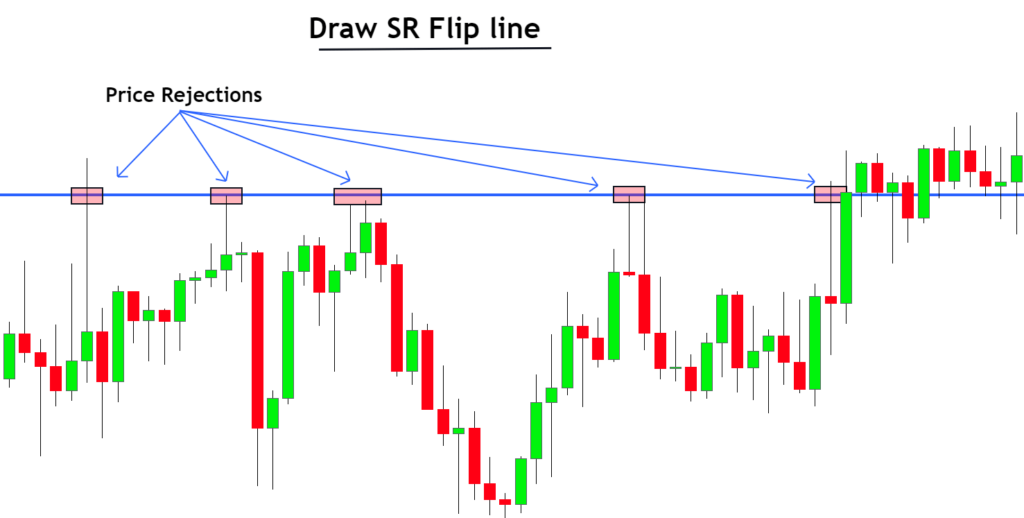

9. Consider Price Action Analysis:

Price action analysis involves interpreting price charts without relying on indicators. Traders who master price action can identify patterns, trends, and potential reversal points with a high degree of accuracy. This approach empowers traders to generate signals based on pure market dynamics.

10. Continuous Learning and Adaptation:

The Forex market is dynamic, and staying ahead requires continuous learning and adaptation. Traders should stay informed about emerging market trends, new analytical tools, and evolving strategies. An adaptable approach ensures that traders remain equipped to interpret signals accurately in changing market conditions.

Conclusion:

Obtaining accurate Forex signals is a multifaceted process that involves leveraging reputable services, mastering technical and fundamental analysis, and incorporating risk management strategies. By combining these approaches and maintaining a commitment to continuous learning, traders can enhance their ability to navigate the complexities of the Forex market with precision.