How to Understand Forex Trading Signals

Understanding Forex trading signals is crucial for traders seeking to navigate the complex and dynamic foreign exchange market. These signals provide insights into potential market movements, helping traders make informed decisions. In this article, we explore the key aspects of comprehending Forex trading signals, delving into their significance, types, and strategies for effective interpretation.

1. Significance of Forex Trading Signals:

1.1 Decision-Making Support:

Forex trading signals serve as a support system for decision-making. They offer traders valuable information about potential entry and exit points, helping them execute trades with a higher probability of success.

1.2 Timing and Precision:

Timing is critical in Forex trading, and signals provide traders with precise timing for market entry and exit. Understanding these signals enhances a trader's ability to capitalize on favorable market conditions.

1.3 Risk Management:

Forex signals often come with suggested stop-loss and take-profit levels, contributing to effective risk management. Traders can use this information to set parameters that align with their risk tolerance and overall trading strategy.

2. Types of Forex Trading Signals:

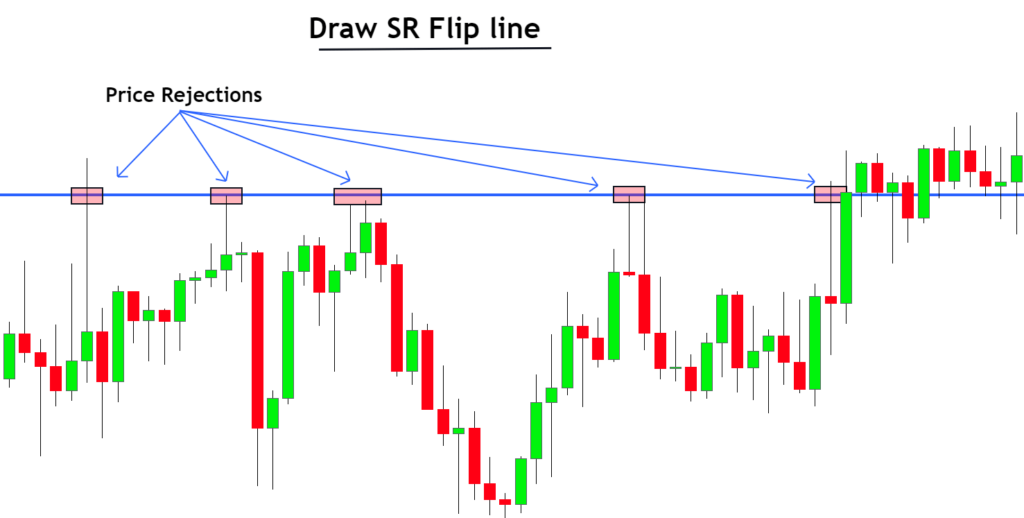

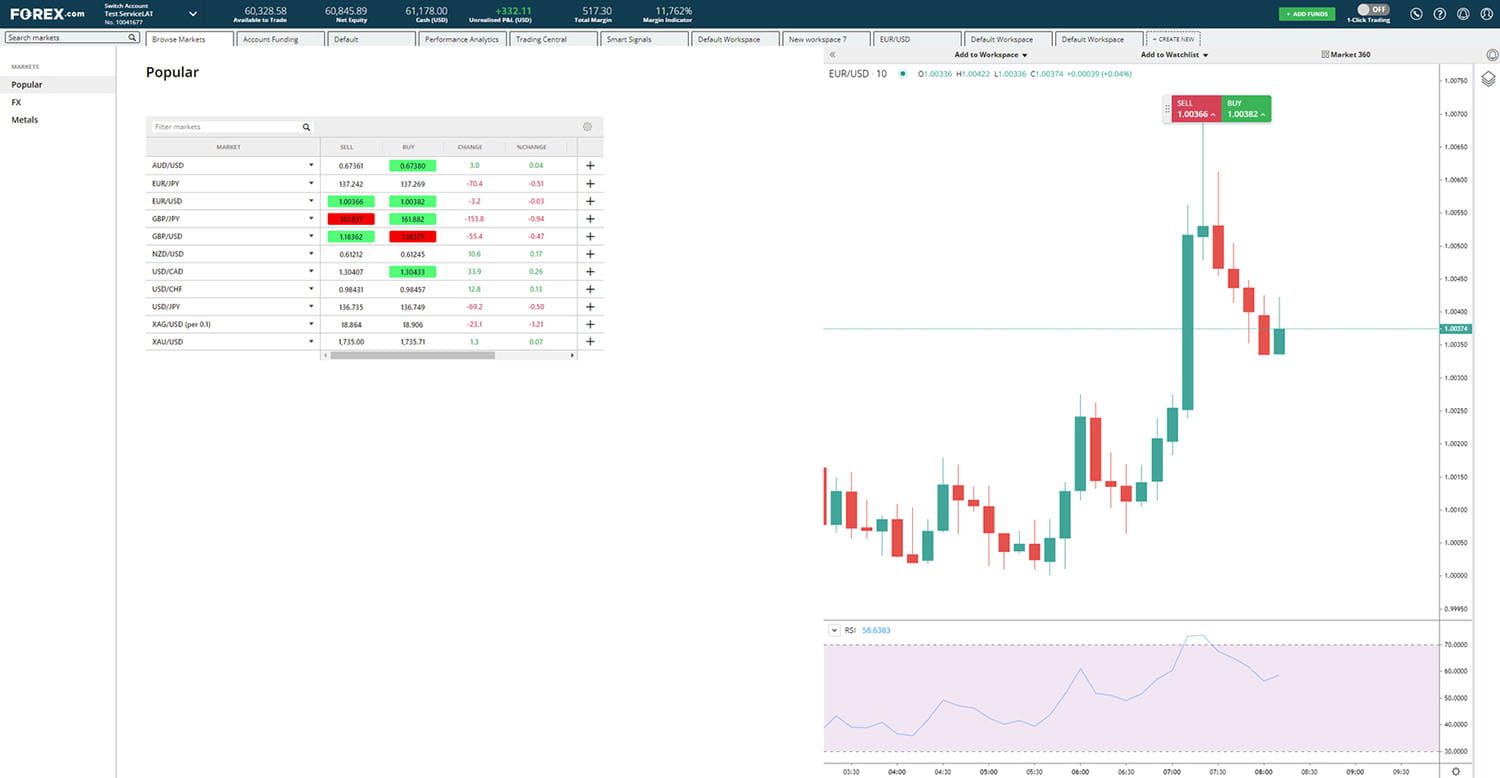

2.1 Technical Signals:

Technical signals are generated using technical analysis tools and indicators. Examples include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and chart patterns. Technical signals are based on historical price data and mathematical calculations.

2.2 Fundamental Signals:

Fundamental signals are driven by economic indicators, news releases, and geopolitical events. Traders employing fundamental analysis consider factors like interest rates, economic data, and political developments to anticipate currency movements.

2.3 Sentiment Signals:

Sentiment signals gauge the overall market sentiment by assessing the positioning and attitudes of traders. Contrarian traders may use sentiment signals to identify potential market reversals when the majority of traders are positioned in one direction.

3. Strategies for Effective Interpretation:

3.1 Combine Multiple Signals:

Combining signals from different sources and types can provide a more comprehensive view of the market. Traders often use a mix of technical, fundamental, and sentiment signals to confirm their trading decisions.

3.2 Backtesting:

Backtesting involves testing a trading strategy using historical data to assess its performance. Traders can apply Forex signals to past market conditions to evaluate how well the signals would have performed. This helps in identifying the strengths and weaknesses of the signals.

3.3 Evaluate Risk-Reward Ratio:

Before acting on a Forex signal, evaluate the risk-reward ratio associated with the trade. Ensure that the potential reward justifies the risk, and set appropriate stop-loss and take-profit levels based on the information provided by the signal.

3.4 Consider Market Conditions:

Market conditions play a crucial role in the effectiveness of Forex signals. Consider the current market environment, including volatility and liquidity, to assess whether the signals align with the prevailing conditions.

4. Common Pitfalls to Avoid:

4.1 Overreliance on Signals:

Avoid overreliance on signals without understanding the underlying analysis. Traders should use signals as a tool for decision-making but also develop a solid understanding of the market and trading principles.

4.2 Ignoring Market Context:

Ignoring the broader market context can lead to misinterpretation of signals. Consider the overall economic landscape, global events, and currency correlations to enhance the context of the signals.

4.3 Emotional Trading:

Emotional trading can cloud judgment and lead to impulsive decisions. Stick to the predetermined plan and strategy based on the signals, avoiding emotional reactions to short-term market fluctuations.

5. Continuous Learning and Adaptation:

5.1 Stay Informed:

Forex markets are dynamic and influenced by a multitude of factors. Stay informed about global economic developments, geopolitical events, and changes in market sentiment to adapt your interpretation of signals accordingly.

5.2 Learn from Experience:

Continuous learning from experience is essential in Forex trading. Evaluate your trades, analyze the effectiveness of signals, and learn from both successes and failures to refine your trading approach.

Conclusion:

Understanding Forex trading signals is an ongoing process that requires a combination of technical knowledge, strategic thinking, and adaptability. Traders who develop a comprehensive understanding of signals and incorporate them into a well-defined trading strategy can enhance their decision-making and navigate the complexities of the Forex market with greater confidence.