How to Create an Automated Forex Trading System

Automated Forex trading systems have become integral tools for traders seeking efficiency, consistency, and the ability to execute strategies without constant manual oversight. Developing a robust automated trading system requires careful planning, strategy formulation, and technical proficiency. In this article, we guide you through the essential steps to create an automated Forex trading system, empowering you to harness the benefits of automation in the dynamic foreign exchange market.

1. Define Your Trading Strategy:

1.1 Strategy Objectives:

Clearly define the objectives of your trading strategy. Whether you're aiming for trend following, mean reversion, or breakout strategies, a well-defined objective forms the foundation of your automated system.

1.2 Technical Indicators and Parameters:

Select the technical indicators and parameters that align with your strategy. Consider using a combination of indicators such as moving averages, RSI, MACD, or custom indicators specific to your trading approach.

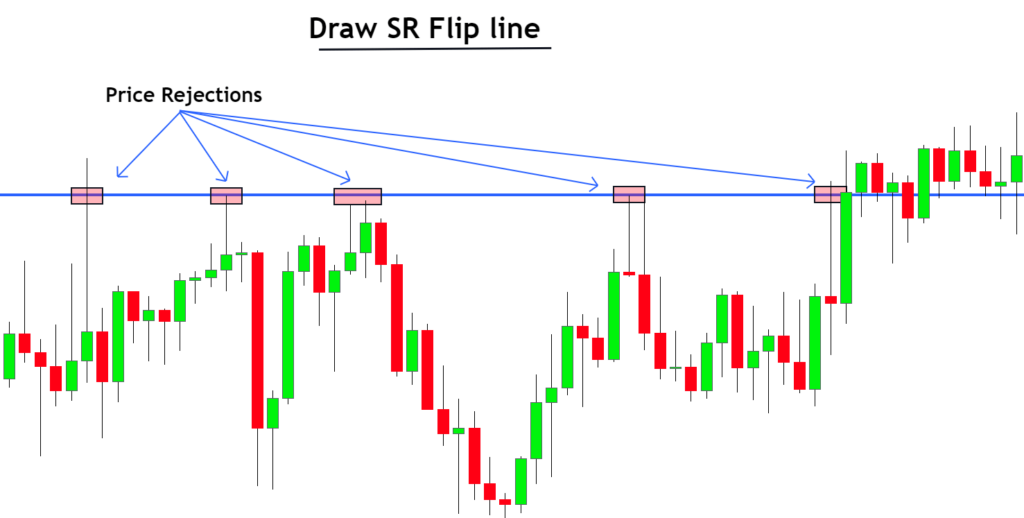

1.3 Entry and Exit Rules:

Establish precise entry and exit rules based on your chosen indicators. Define the conditions under which your system will enter a trade, set stop-loss and take-profit levels, and determine criteria for closing positions.

2. Choose a Suitable Trading Platform:

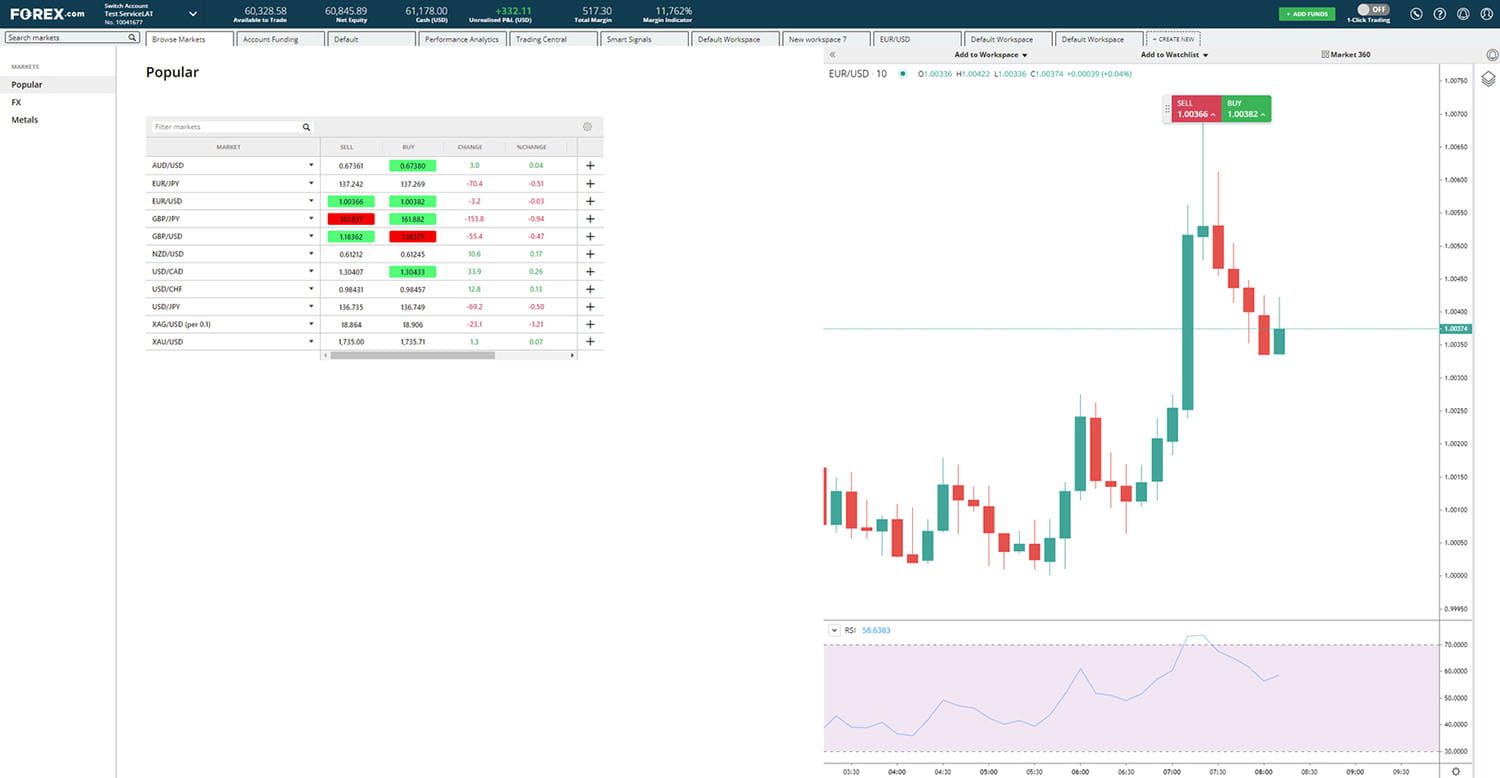

2.1 Compatibility:

Choose a trading platform that supports algorithmic trading and is compatible with your programming language of choice. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used and offer robust support for automated trading.

2.2 Programming Language:

Familiarize yourself with the programming language supported by your chosen platform. MetaTrader platforms, for example, use MQL4 and MQL5. Understanding the syntax and capabilities of the language is crucial for effective coding.

3. Learn a Programming Language:

3.1 Programming Skills:

Develop proficiency in the programming language of your chosen trading platform. Whether it's MQL4, MQL5, Python, or another language, a solid understanding is essential for translating your trading strategy into code.

3.2 Algorithmic Logic:

Translate your trading strategy's logic into algorithmic form. This involves converting your strategy's rules and conditions into code that the automated system can understand and execute.

4. Backtesting Your System:

4.1 Historical Data:

Acquire historical data relevant to the time frame and instruments you intend to trade. Ensure the data includes various market conditions to comprehensively test the robustness of your automated system.

4.2 Strategy Optimization:

Backtest your system using historical data to assess its performance. Optimize your strategy by adjusting parameters and rules based on backtesting results. Aim for a balance between historical success and adaptability to future market conditions.

5. Risk Management:

5.1 Position Sizing:

Implement effective risk management within your automated system. Define position sizing rules based on factors like account equity, risk per trade, and overall risk tolerance.

5.2 Stop-Loss and Take-Profit:

Set clear stop-loss and take-profit levels within your system to manage potential losses and secure profits. Consider incorporating dynamic stop-loss mechanisms based on market conditions.

6. Real-Time Testing and Optimization:

6.1 Demo Trading:

Implement your automated system in a demo trading environment to observe its real-time performance. This allows you to identify and address any issues before deploying it in live market conditions.

6.2 Continuous Optimization:

Continuously optimize your system based on real-time testing results. Market conditions evolve, and your system should adapt accordingly. Regularly assess the performance and make adjustments as needed.

7. Deploying in Live Markets:

7.1 Start Small:

When deploying your automated system in live markets, start with a small capital allocation. This allows you to observe its behavior in a real trading environment while minimizing potential risks.

7.2 Monitor and Evaluate:

Monitor the performance of your automated system in live markets. Evaluate its adherence to the defined rules and objectives. Be prepared to intervene or make adjustments if needed.

8. Continuous Monitoring and Improvement:

8.1 Stay Informed:

Stay informed about market developments, economic events, and changes in market conditions. This information is crucial for adapting your automated system to evolving circumstances.

8.2 Learning from Experience:

Continuously learn from the live trading experience. Evaluate the effectiveness of your automated system, identify areas for improvement, and apply lessons learned to enhance its performance.

Conclusion:

Creating an automated Forex trading system involves a strategic combination of defining your trading strategy, mastering a programming language, backtesting, risk management, and continuous optimization. By following these steps, you can develop a robust automated system that aligns with your trading objectives and navigates the complexities of the Forex market with precision.