In the dynamic world of Forex trading, finding a broker that combines reliability, comprehensive service, and customer satisfaction is crucial for both novice and experienced traders. ThinkMarkets, a well-known entity in the trading landscape, offers a broad spectrum of services that cater to the diverse needs of individual and institutional investors. This review delves into the service quality, customer feedback, product features, and any associated scam warnings of ThinkMarkets, aiming to furnish traders with a clear picture of what to expect from this broker.

Overview of ThinkMarkets

ThinkMarkets is a global Forex and CFD broker that has been operational for several years, providing access to a wide array of financial instruments, including but not limited to, currencies, stocks, indices, and commodities. It operates under strict regulation from reputable financial authorities such as the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA), which signals its dedication to maintaining high standards of integrity and customer protection.

Service Quality and Customer Satisfaction

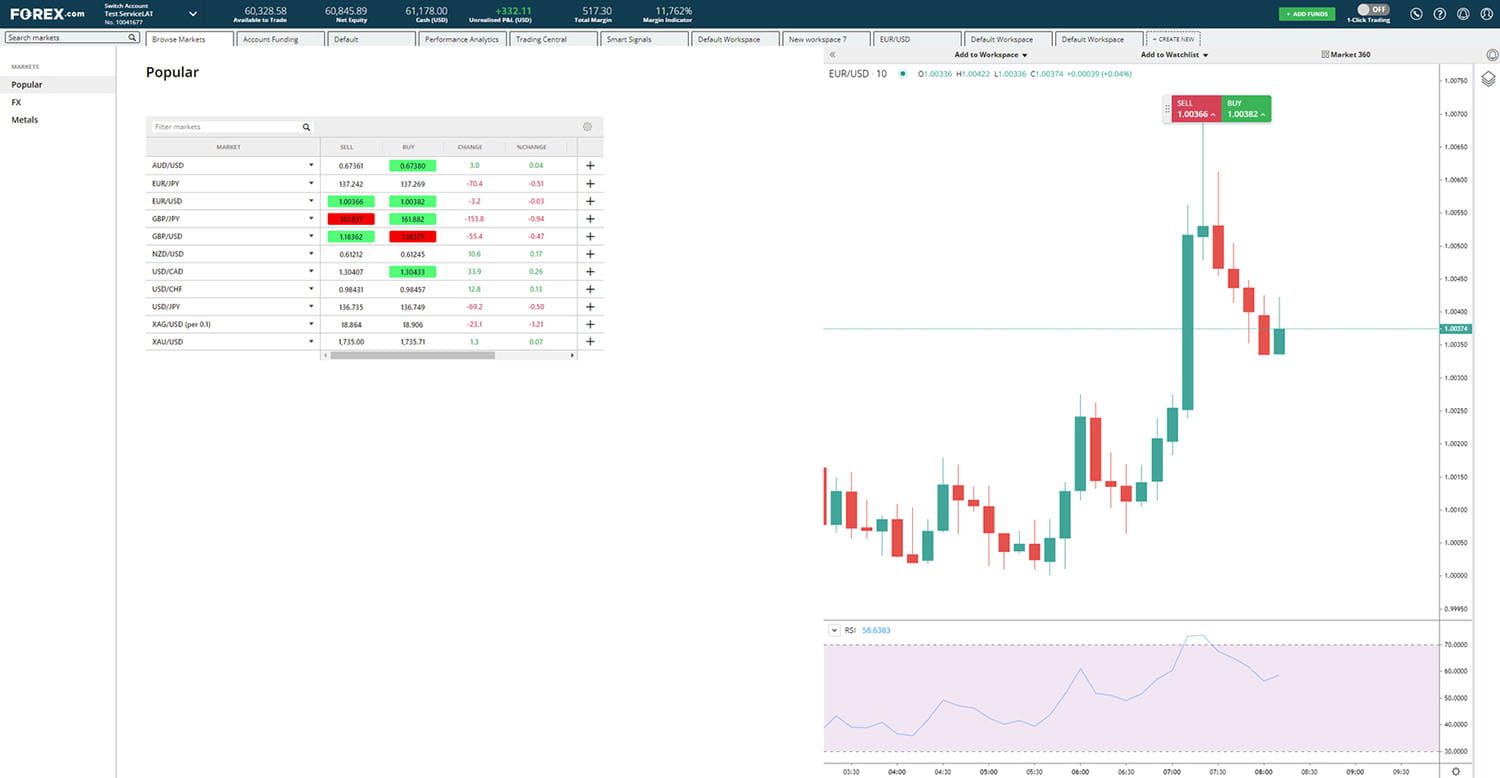

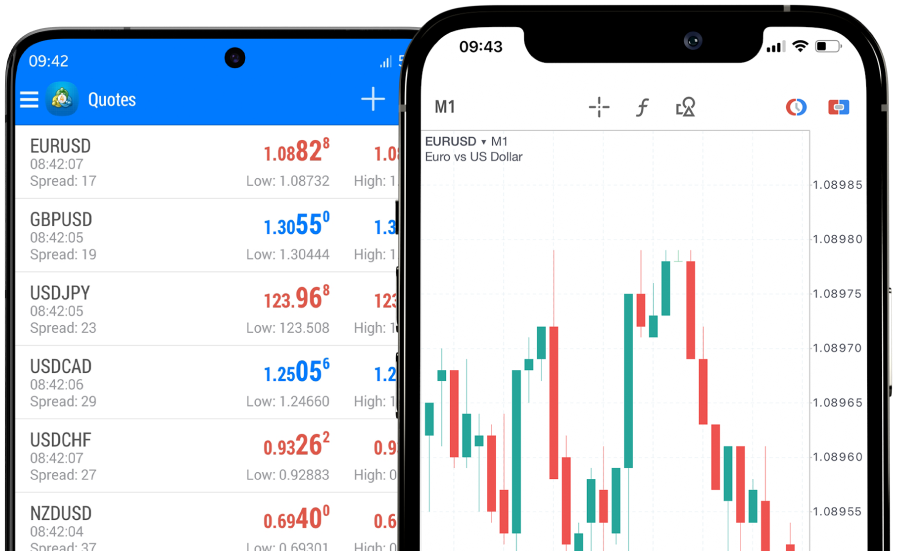

The caliber of service provided by a broker is a fundamental aspect that influences trading success. ThinkMarkets boasts of advanced technology that ensures speedy and reliable execution of trades, a factor that can significantly reduce the risk of slippage and offer traders an advantage in the fast-moving Forex market. Its proprietary trading platform, ThinkTrader, is recognized for its intuitive design, comprehensive analytical tools, and compatibility with mobile devices, enabling traders to monitor and execute trades from anywhere.

Feedback from customers across various online platforms presents a nuanced view of ThinkMarkets. Many traders have lauded the broker for its effective customer support, available 24/5, and its rich repository of market analysis materials. On the flip side, there are reports from some users about delays in account verification and withdrawal processes. It is worth noting, however, that such issues are relatively common in the brokerage industry and often vary from case to case.

Product Features and Trading Conditions

ThinkMarkets offers an array of products and trading tools designed to meet the needs of a diverse trading community. It provides leverage of up to 500:1, competitive spreads, and low commission rates, which are crucial elements that affect a trader’s bottom line. The broker’s emphasis on risk management, including features like negative balance protection and stop-loss orders, plays a pivotal role in safeguarding traders’ investments.

The broker also distinguishes itself through its investment in educational resources, offering an extensive library of webinars, tutorials, and articles that span a wide range of trading topics. This commitment to trader education underscores ThinkMarkets’ focus on fostering long-term success among its clients, rather than merely profiting from their trades.

Scam Alerts and Security Measures

In a sector where the risk of scams is a constant concern, it is imperative for traders to examine the security measures in place and any scam alerts related to their prospective broker. ThinkMarkets has established a commendable track record of adhering to regulatory standards and providing a high degree of client fund protection. The firm ensures that client funds are kept in segregated accounts at top-tier banks, a practice that safeguards traders' capital from being misused.

While there have been no major scam alerts involving ThinkMarkets, traders are encouraged to conduct thorough due diligence and remain vigilant. Regulatory compliance is a positive indicator, but it is also essential to assess other aspects such as the transparency of trading conditions, fee structures, and the broker’s history of client relations.

Conclusion

For those in the quest for a Forex and CFD broker in 2024, ThinkMarkets offers a compelling blend of regulatory security, a wide range of trading tools, and a commitment to customer service. Although no broker is without challenges, the proactive steps taken by ThinkMarkets to ensure a secure, transparent, and supportive trading environment are apparent.

Prospective clients should undertake personal research and make full use of the educational and analytical resources provided by ThinkMarkets. As the Forex market continues to evolve, the importance of aligning with a broker that mirrors your trading objectives and principles becomes increasingly critical. With its robust offerings and strong regulatory framework, ThinkMarkets merits consideration from those navigating the complexities of Forex trading.