In the labyrinth of Forex trading, the quest for a reliable and competent broker is paramount for both beginners and veterans of the trade. ThinkMarkets stands out as a beacon for those navigating the complexities of currency and commodity markets. This review will scrutinize ThinkMarkets in 2024, focusing on the quality of its services, customer feedback, product features, and any warnings of fraudulent activity. Our goal is to provide an objective lens through which individual and institutional investors can assess ThinkMarkets as their potential trading partner.

Company Background

ThinkMarkets is a global broker specializing in Forex and contracts for difference (CFDs), offering a broad spectrum of trading options that include currencies, stocks, indices, metals, and cryptocurrencies. Founded with the trader's success in mind, ThinkMarkets operates under the regulation of several esteemed bodies, such as the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA). This multi-regulatory compliance underscores its commitment to upholding the highest standards of operation and client security.

Service Quality

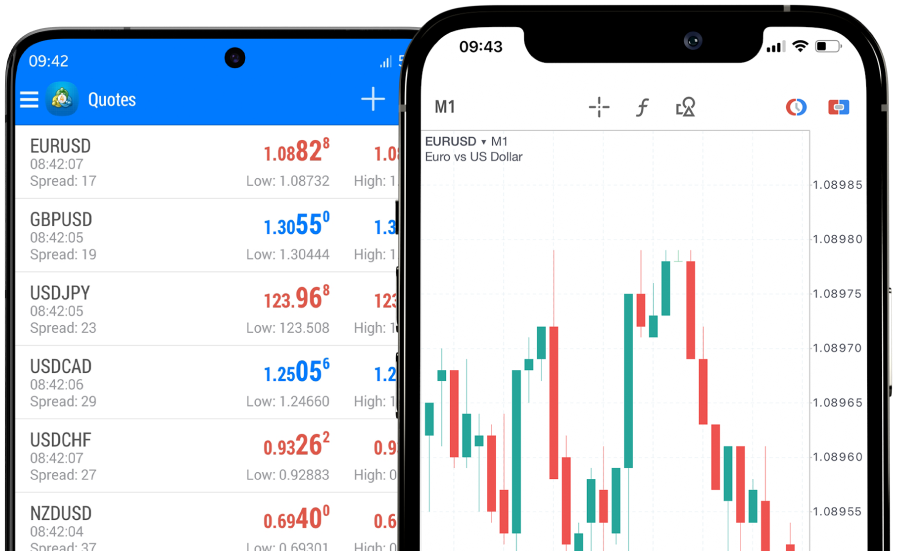

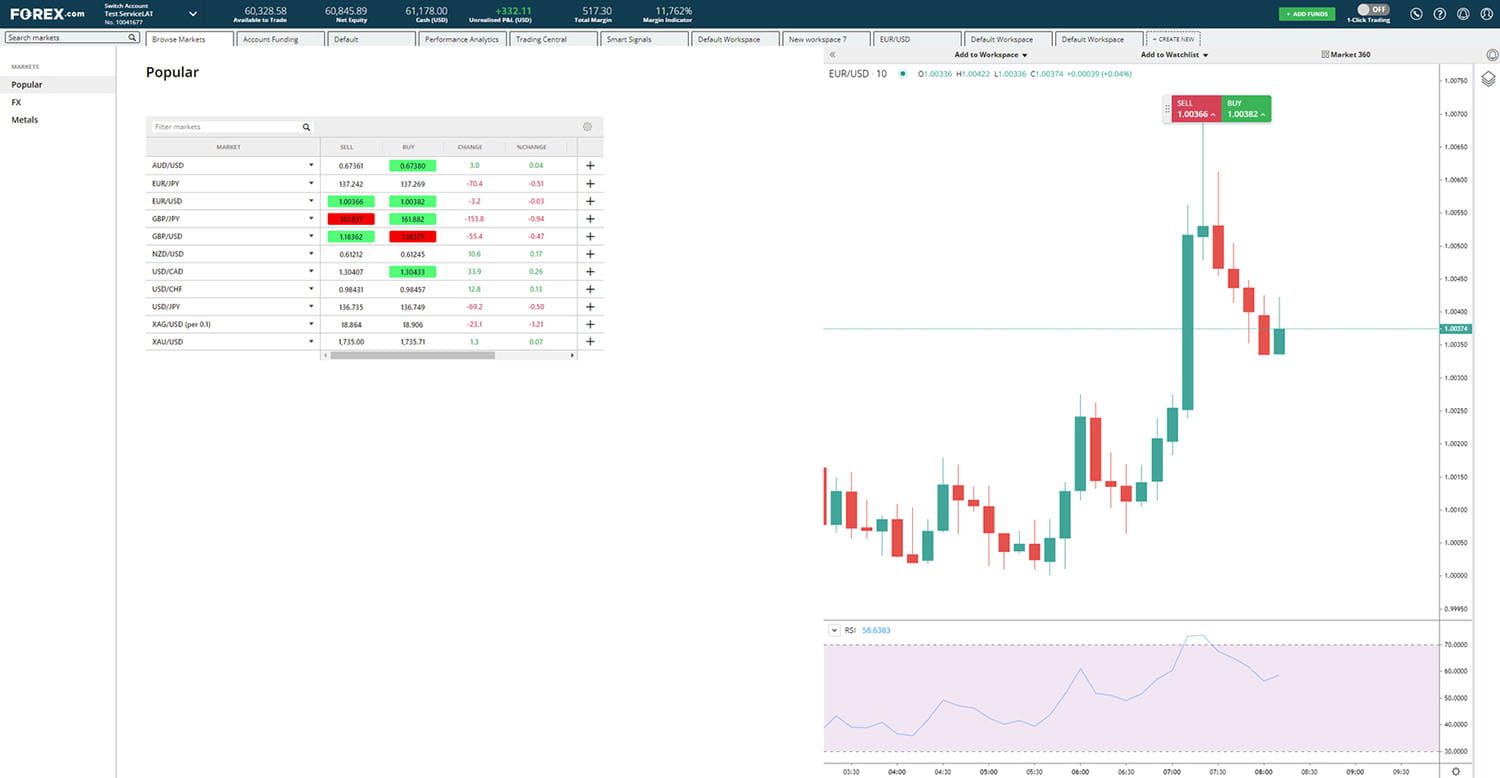

The essence of ThinkMarkets' appeal lies in its robust trading infrastructure, which facilitates swift and reliable execution of trades. This efficiency is crucial in the volatile Forex market, where milliseconds can make a significant difference in trade outcomes. ThinkMarkets prides itself on its proprietary trading platform, ThinkTrader, known for its user-friendly interface, advanced charting capabilities, and seamless mobile app integration. These features empower traders to make informed decisions promptly, whether at home or on the move.

Customer Feedback

Engaging with user feedback unveils a spectrum of experiences. Many traders have expressed satisfaction with ThinkMarkets’ technical reliability, educational resources, and responsive customer service. Highlights from user testimonials include appreciation for the depth of market analysis tools and the accessibility of support teams. Nevertheless, some criticisms have emerged regarding withdrawal delays and account verification procedures. It's pertinent to recognize that such challenges are not exclusive to ThinkMarkets and are somewhat ubiquitous across the Forex brokerage industry.

Product Features

ThinkMarkets differentiates itself with an expansive array of trading products and features designed to cater to a wide range of trading strategies and preferences. Notably, the broker offers competitive leverage options, tight spreads, and low commission structures, which can significantly impact a trader’s profitability. Moreover, the inclusion of risk management tools, such as negative balance protection and customizable stop-loss orders, reflects ThinkMarkets’ proactive stance on safeguarding its clients' investments.

An impressive facet of ThinkMarkets is its commitment to trader education and development. The broker provides a comprehensive suite of learning materials, including webinars, e-books, and video tutorials, covering various aspects of trading and market analysis. This educational support is instrumental in building the knowledge and confidence of traders at all levels of expertise.

Scam Alerts and Security

In an era where digital security is paramount, ThinkMarkets demonstrates a rigorous approach to protecting client assets and information. The broker's adherence to stringent regulatory standards is a testament to its reliability. Client funds are held in segregated accounts with top-tier banks, ensuring protection from unauthorized use. While the trading landscape is fraught with scam alerts, ThinkMarkets has maintained a clean slate, bolstered by its transparent operational practices and positive trader testimonials.

However, vigilance remains key. Traders are encouraged to perform their due diligence, stay informed about market conditions, and critically assess any broker's credibility and performance.

Conclusion

ThinkMarkets represents a compelling choice for Forex and CFD traders in 2024, offering a blend of technological sophistication, comprehensive regulatory compliance, and a trader-centric service model. While challenges exist, as with any brokerage, ThinkMarkets’ commitment to excellence, security, and trader success is evident.

For those considering ThinkMarkets, leveraging its educational resources, testing its platforms through demo accounts, and engaging with its community can provide valuable insights. As the financial markets continue to evolve, aligning with a broker that not only meets but anticipates your needs is crucial. ThinkMarkets, with its rich array of offerings and steadfast dedication to trader support, is well-positioned to be such a partner.