In the dynamic world of Forex trading, selecting the right platform is crucial for both novices and seasoned traders alike. With a multitude of options available, it's essential to conduct a thorough analysis to uncover the strengths, weaknesses, and distinctive features of top Forex trading platforms. In this comprehensive review, we delve into RoboForex in 2024, examining its pros, cons, and key features to empower traders with informed decision-making.

Introduction

As we step into 2024, RoboForex continues to stand as a formidable contender in the Forex trading arena. With its array of offerings and technological advancements, RoboForex beckons traders to explore its platform for profitable ventures. However, to navigate this terrain effectively, one must dissect its attributes objectively.

Pros of RoboForex in 2024

Diverse Trading Instruments: RoboForex boasts an extensive range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. This diversity enables traders to capitalize on various market opportunities and diversify their portfolios effectively.

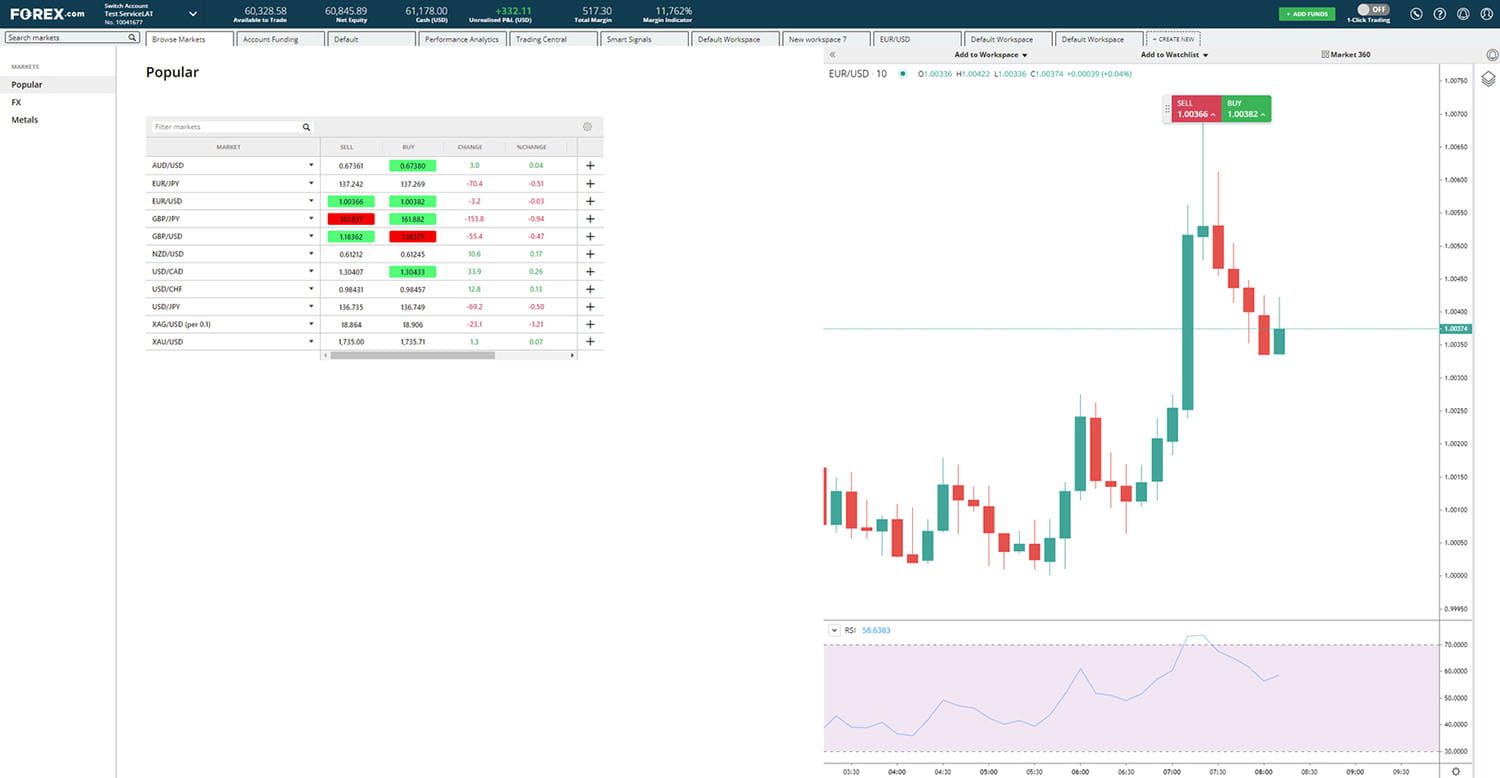

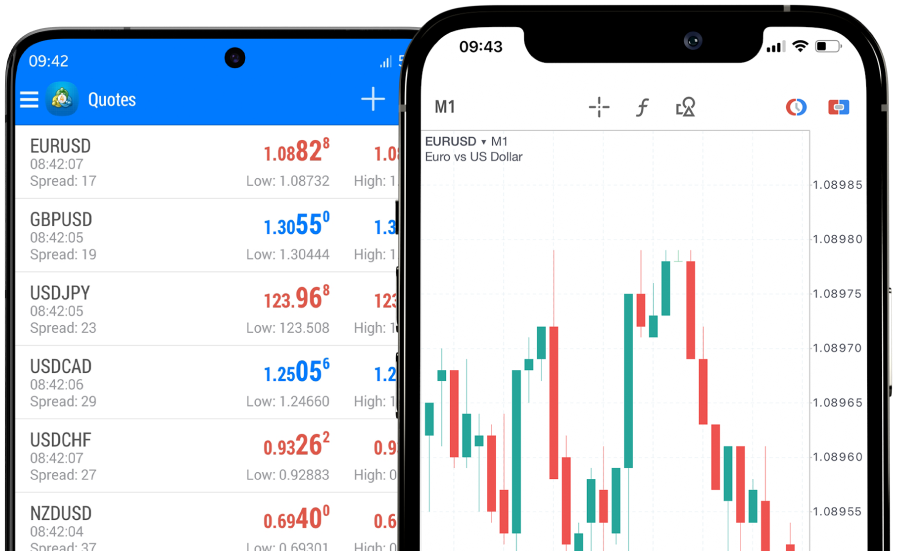

Advanced Technological Infrastructure: Leveraging cutting-edge technology, RoboForex provides traders with access to advanced trading tools and platforms. From MetaTrader 5 to cTrader, traders can choose the platform that best aligns with their trading preferences and strategies.

Competitive Spreads and Low Commissions: RoboForex offers competitive spreads and low commissions, ensuring cost-effective trading for its users. This cost efficiency allows traders to maximize their profits and minimize their expenses, enhancing overall profitability.

Robust Educational Resources: Recognizing the importance of education in trading success, RoboForex provides a wealth of educational resources, including webinars, tutorials, and market analysis. These resources empower traders with knowledge and insights to make informed trading decisions.

Cons of RoboForex in 2024

Execution Delays: Despite its technological advancements, RoboForex occasionally experiences execution delays, leading to frustration among traders. These delays can impact trading outcomes, especially in fast-moving markets, requiring traders to exercise patience and caution.

Complex Fee Structure: Some users find RoboForex's fee structure complex to navigate, with multiple fees and charges associated with various trading activities. This complexity can pose challenges for novice traders in understanding their cost implications accurately.

Key Features of RoboForex

Copy Trading: RoboForex offers a copy trading feature, allowing users to replicate the trades of experienced traders automatically. This feature enables novice traders to learn from seasoned professionals and potentially profit from their expertise.

RoboForex Analytics: RoboForex Analytics provides traders with comprehensive market analysis, including technical and fundamental insights, economic news, and expert commentary. This tool equips traders with the information they need to make informed trading decisions.

24/7 Customer Support: RoboForex offers round-the-clock customer support to assist traders with any queries or issues they may encounter. This commitment to customer service enhances the overall trading experience and instills confidence among users.

Conclusion

In conclusion, RoboForex in 2024 presents a compelling option for Forex traders, offering a diverse range of trading instruments, advanced technology, and robust educational resources. While it boasts numerous strengths, it's not without its drawbacks, including execution delays and a complex fee structure. By weighing the pros and cons and leveraging its key features, traders can harness the potential of RoboForex for profitable trading endeavors.