Pepperstone is widely recognized in the financial world for its robust online trading services, particularly in Forex and CFDs. The broker has garnered attention not only for its trading platform but also for its customer service, educational resources, and overall trading experience. This article provides an in-depth review of Pepperstone, focusing on user feedback, the account opening process, and what traders can expect when they choose to engage with this platform.

Company Background

Pepperstone was established in 2010 in Melbourne, Australia, with the mission to create a world of tech-enabled trading where ambitious traders can embrace the challenge and opportunity of global markets. Over the years, Pepperstone has expanded its services globally, obtaining regulatory licenses in major jurisdictions, which include the Australian Securities and Investments Commission (ASIC), the UK's Financial Conduct Authority (FCA), and the Dubai Financial Services Authority (DFSA), among others. This global footprint not only underscores Pepperstone’s reliability but also its commitment to adhering to strict regulatory standards.

User Reviews

The consensus among many traders is that Pepperstone offers a seamless trading experience, highlighted by fast execution speeds, low spreads, and minimal slippage. Many users commend the broker for its range of market analysis tools and educational content, which cater to both novice and experienced traders. Customer service also receives high marks, with support available 24/5 and accessible through various channels, including live chat, email, and phone.

However, it’s not all sunshine and rainbows. Some traders express dissatisfaction with account verification times and the occasional platform glitch. It's important for potential users to weigh these reviews in the context of their personal trading needs and preferences.

Account Opening Terms

Opening an account with Pepperstone is a straightforward process designed to get traders up and running without unnecessary delays. The process includes the following steps:

Registration: Potential traders start by filling out an online application form on the Pepperstone website, providing personal information and answering a few basic questions about their trading experience and financial knowledge.

Verification: To comply with regulatory requirements, Pepperstone requires users to verify their identity and residence. This typically involves uploading a government-issued ID and a recent utility bill or bank statement.

Funding: Once the account is verified, traders can fund their account using various methods, including bank transfers, credit cards, and e-wallets. Pepperstone prides itself on offering a wide range of funding options to accommodate traders from different regions.

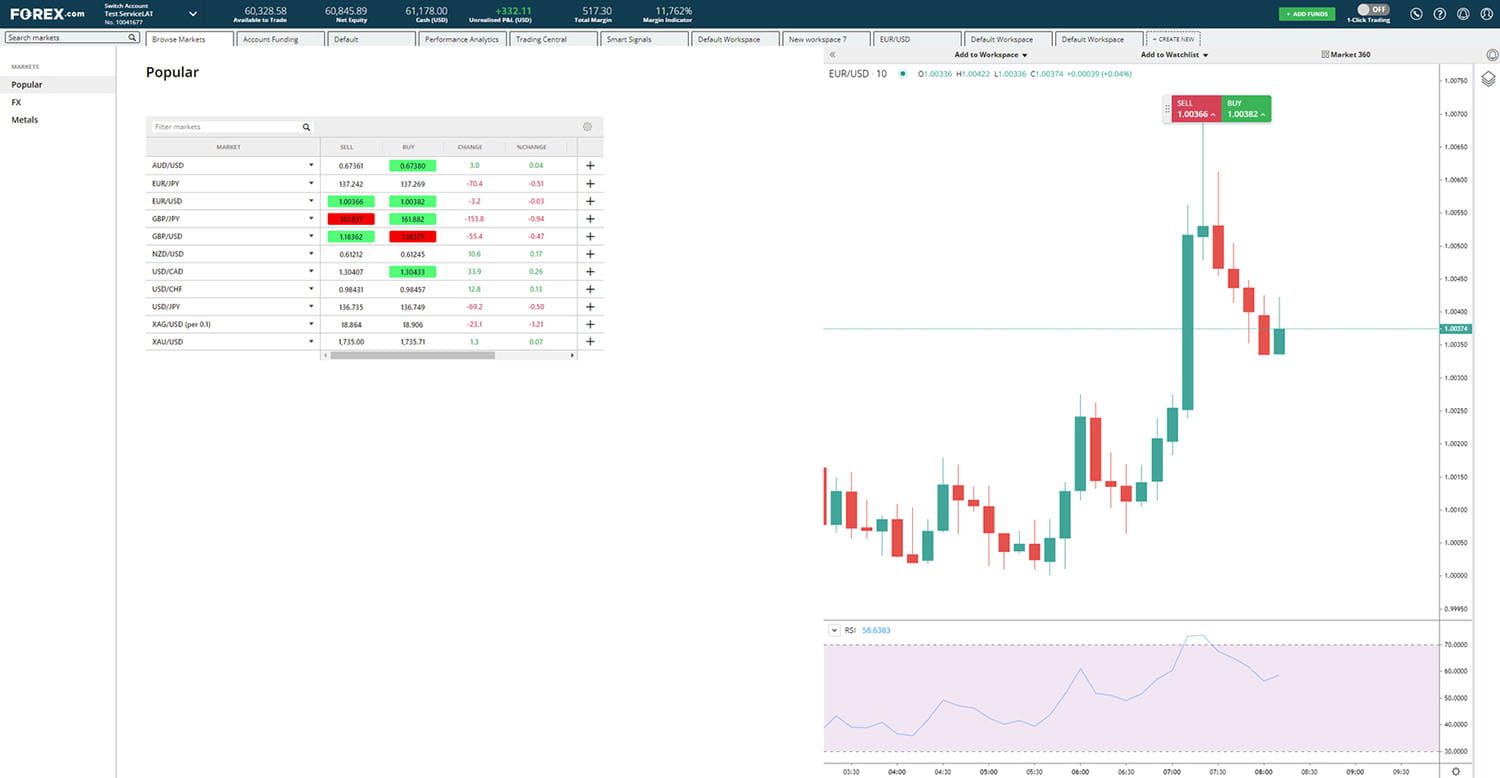

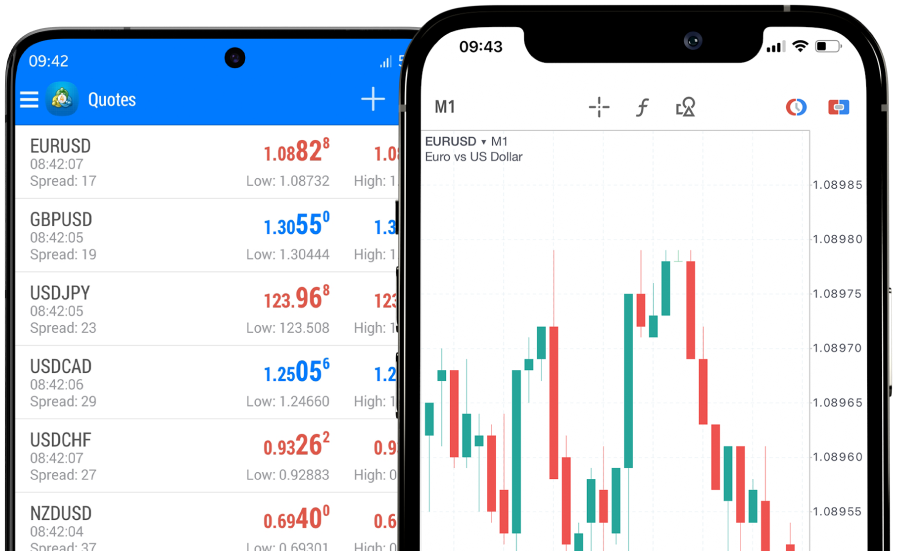

Trading: With the account set up and funded, traders can start trading. Pepperstone offers a selection of platforms, including MetaTrader 4, MetaTrader 5, and cTrader, catering to traders’ diverse needs and preferences.

Trading Platforms and Tools

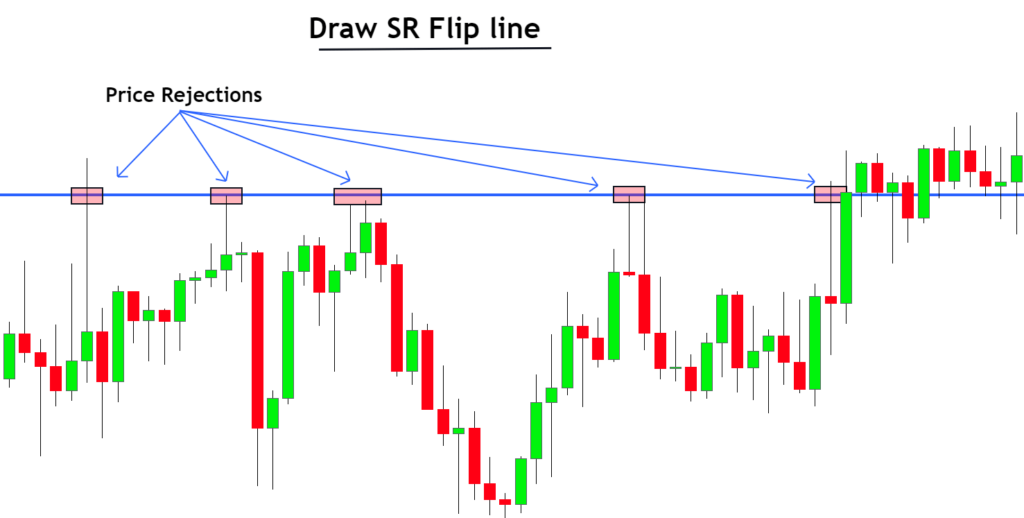

Pepperstone’s selection of platforms is a significant advantage, offering tools and features that cater to different trading strategies and preferences. MetaTrader 4 and 5 are popular for their customizability, advanced charting tools, and algorithmic trading capabilities. cTrader, on the other hand, is lauded for its intuitive interface and sophisticated order execution features.

In addition to these platforms, Pepperstone provides access to social trading, allowing users to copy trades from experienced traders. This feature is particularly appealing to beginners or those looking to diversify their trading strategies.

Education and Resources

Pepperstone invests heavily in trader education and market analysis. Their website features an extensive library of webinars, tutorials, and articles that cover a broad range of topics, from forex basics to advanced technical analysis strategies. This commitment to education is part of Pepperstone’s mission to empower traders to make informed decisions.

Fees and Spreads

Pepperstone is competitive in terms of pricing, offering tight spreads and low commission fees. The broker operates a no dealing desk (NDD) model, ensuring transparent pricing and fast execution. Spreads on major currency pairs are competitive, and the broker is transparent about its fee structure, which helps traders manage their trading costs effectively.

Conclusion

Pepperstone stands out in the crowded field of online brokers for its commitment to providing a high-quality trading experience. Its regulatory compliance, comprehensive trading platforms, educational resources, and responsive customer service contribute to its positive reputation among traders. While there are occasional criticisms, the overall sentiment is overwhelmingly positive, making Pepperstone a strong contender for traders looking for a reliable and efficient trading partner.

As with any broker, potential users should conduct their own due diligence, considering their trading needs, preferences, and the inherent risks of trading. For those who decide that Pepperstone meets their criteria, the broker offers a compelling mix of technology, support, and resources designed to facilitate successful trading.