IC Markets is one of the leading forex brokers globally, known for its robust trading platforms and competitive trading conditions. This review evaluates IC Markets comprehensively, focusing on its advantages and disadvantages to help both new and experienced forex traders make an informed choice. Using industry trends, statistical data, and user feedback, we delve into what sets IC Markets apart in the competitive forex trading landscape.

Pros of IC Markets

1. Low Trading Costs

Spreads and Commissions: IC Markets is renowned for its low spreads, starting from 0.0 pips on major currency pairs. This is particularly advantageous for scalpers and high-volume traders. The broker charges a competitive commission rate of $3.50 per lot per side for its cTrader and MetaTrader Raw accounts, which is below the industry average.

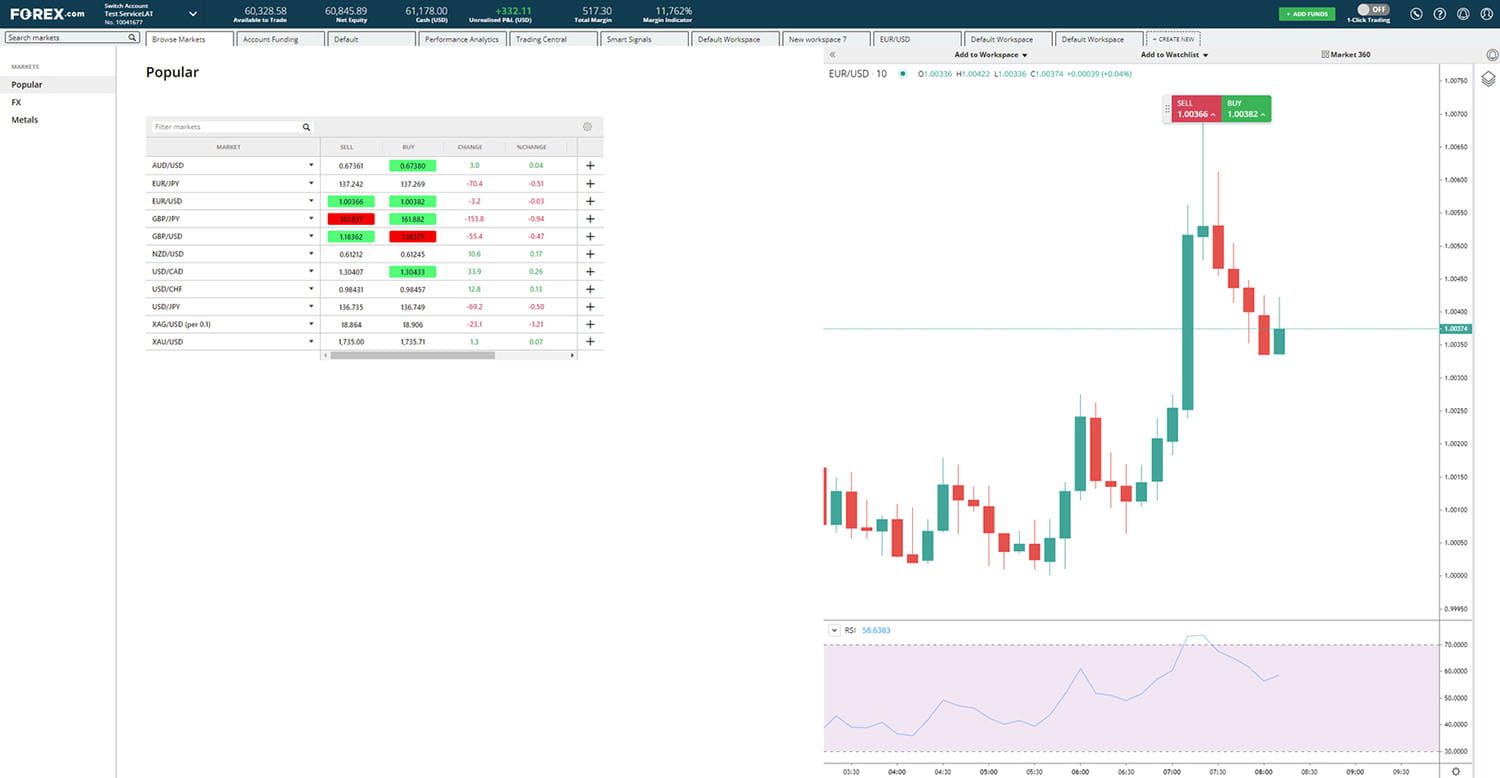

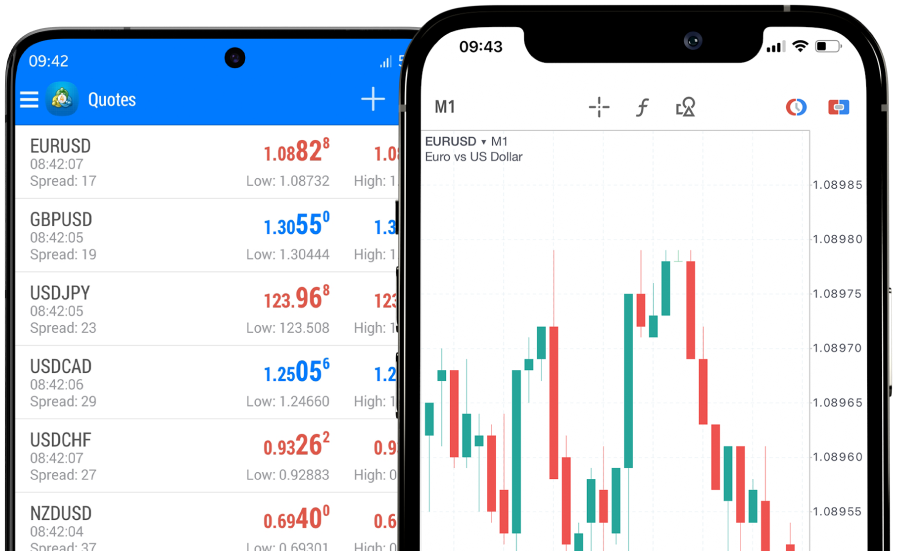

2. Advanced Trading Platforms

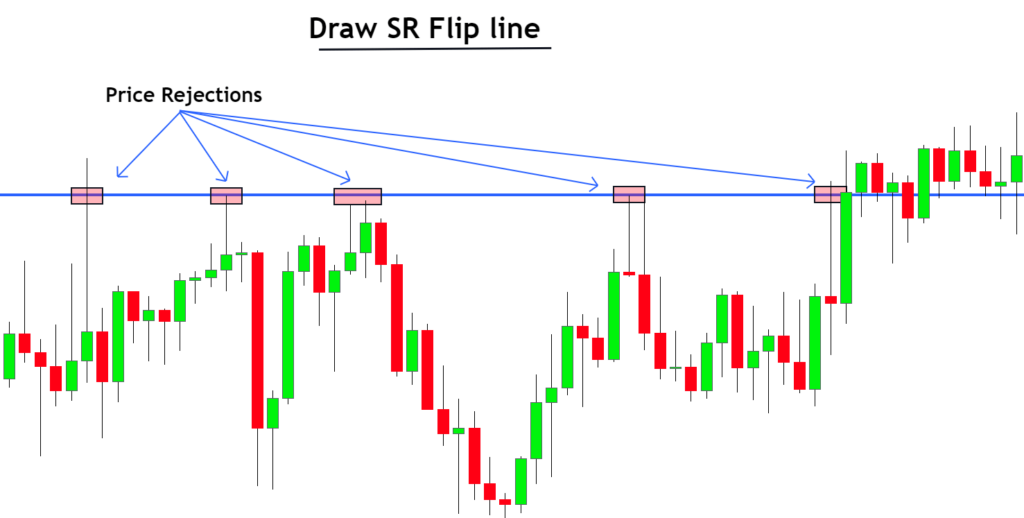

MetaTrader and cTrader: IC Markets offers both MetaTrader 4 and MetaTrader 5 platforms, which are popular for their reliability and extensive range of features. Additionally, IC Markets supports the cTrader platform, known for its superior charting tools, level II pricing, and complex order types that cater to advanced traders.

3. Regulatory Compliance

Trust and Security: Regulated by top-tier authorities such as the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), IC Markets provides traders with the assurance of trading with a reliable and well-regulated broker.

4. Excellent Customer Support

Service and Responsiveness: IC Markets excels in customer service, offering 24/7 support through live chat, email, and phone. Their service is noted for its responsiveness and helpfulness, crucial for addressing the urgent needs of active traders.

Cons of IC Markets

1. Limited Product Portfolio

Focus on Forex and CFDs: Unlike some competitors that offer a wide range of trading instruments including stocks, options, and bonds, IC Markets mainly focuses on forex and CFDs. This can be a limitation for traders looking to diversify their trading strategies across different asset classes.

2. Geographic Restrictions

Services in USA and Canada: Traders from the USA and Canada cannot open accounts with IC Markets due to regulatory constraints. This geographic limitation restricts the broker’s global reach.

3. Complexity for Beginners

User Experience: While IC Markets offers advanced functionalities that benefit experienced traders, beginners may find the platform complex and intimidating. The lack of tailored educational resources for novice traders exacerbates this issue.

Market Trends and User Feedback

Industry Trends

The forex broker market is evolving, with a significant emphasis on lowering trading costs and enhancing technological infrastructure. IC Markets has remained competitive by continuously upgrading its services to meet these demands, evident from its adoption of next-gen trading platform features and aggressive pricing strategies.

Statistical Data and Case Studies

Data shows that IC Markets manages an impressive daily trading volume, which underscores its position as a preferred broker among high-frequency traders. This high volume also contributes to the liquidity and execution speed that IC Markets offers.

User Feedback

Positive reviews frequently highlight IC Markets’ efficient customer service and competitive pricing. However, some users have expressed dissatisfaction with the onboarding process and the platform's complexity for beginners. These mixed reviews suggest that while IC Markets excels in many areas, there is room for improvement in user experience and accessibility.

Conclusion

IC Markets stands out as a top forex broker with several strengths, including competitive fees, strong regulatory oversight, advanced trading tools, and excellent customer support. However, its product offering is somewhat limited, and geographic restrictions may deter a broader clientele. Moreover, the platform's complexity could be daunting for newcomers to forex trading.

For traders seeking a reliable and cost-effective trading environment, IC Markets remains a strong choice, especially for those who prioritize sophisticated trading tools and low-cost trading. As always, traders should consider their specific needs and experience levels before choosing a broker.