Forex trading signals are crucial tools for both novice and experienced traders, offering insights into potentially profitable trading opportunities. ThinkMarkets, a recognized platform in the forex industry, provides comprehensive trading signals that cater to various trading styles and preferences. This article explores how traders can effectively utilize these signals and assesses the role they play in enhancing trading strategies.

Understanding Forex Trading Signals

Definition and Types

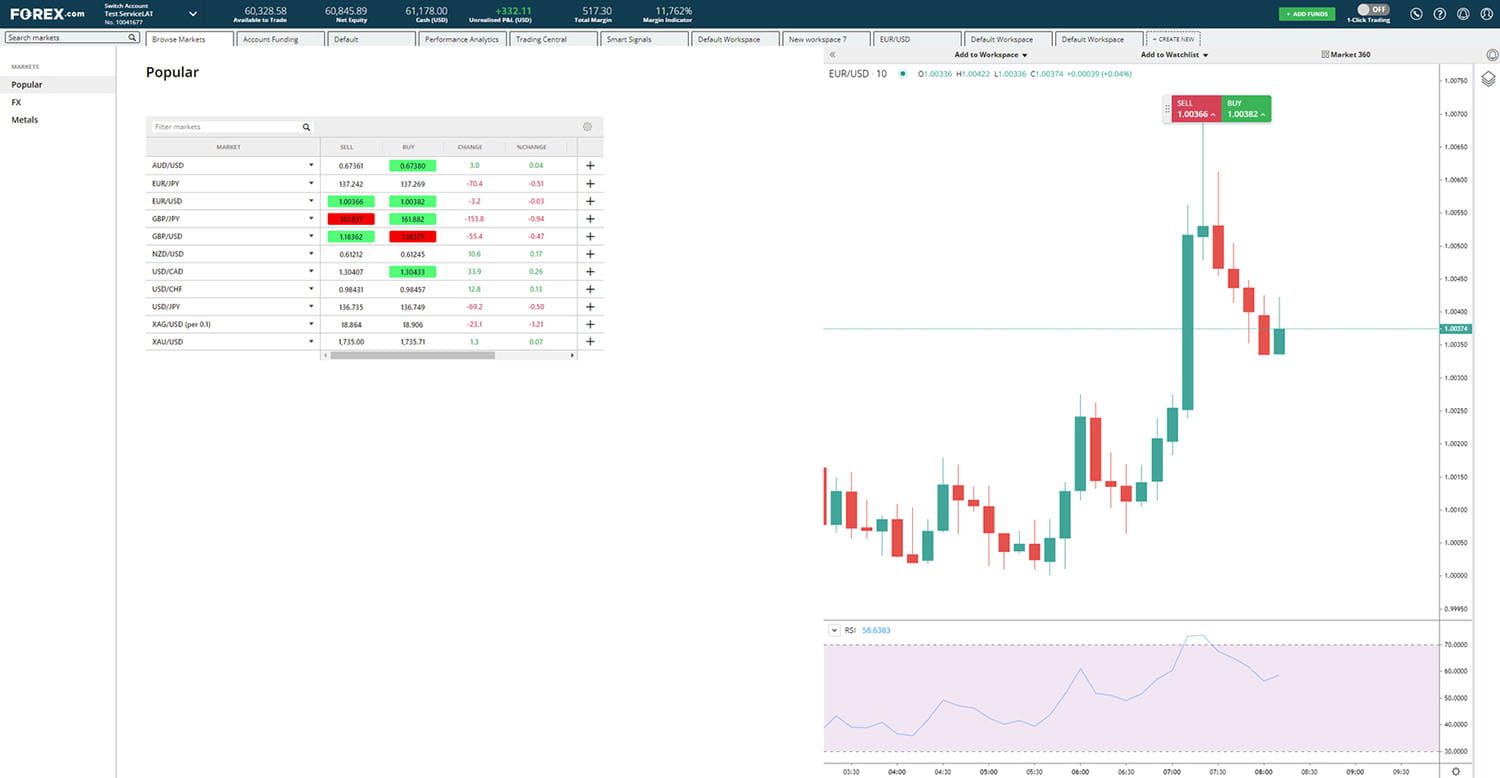

Forex trading signals are indicators or suggestions on trading opportunities in the forex market. These signals can be based on various analytical techniques, including technical analysis, fundamental analysis, or a combination of both. ThinkMarkets provides a range of signals, such as:

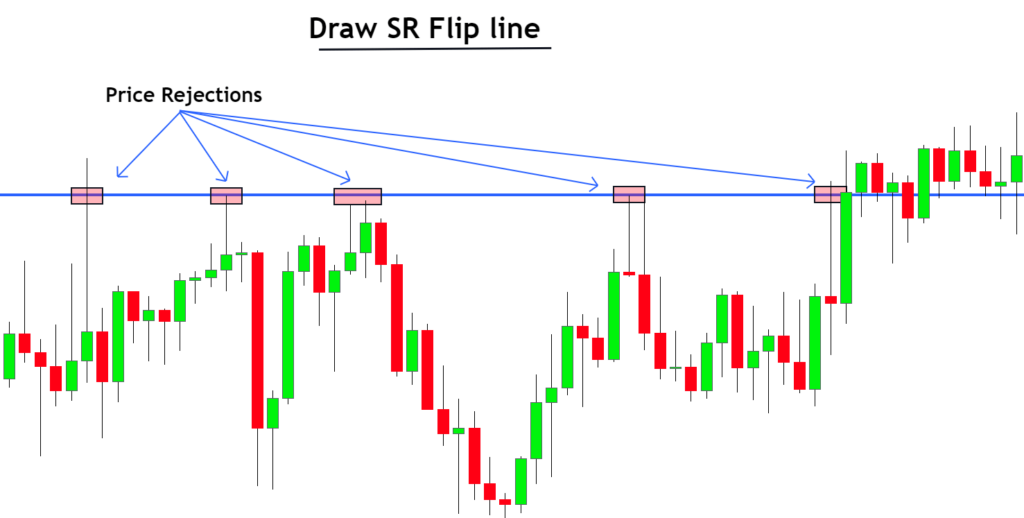

Price Action Signals: Indicate significant price movements and patterns.

Technical Indicators: Include signals from tools like moving averages, RSI, or MACD.

Economic News Alerts: Based on fundamental analysis of economic data releases.

Sources and Reliability

The source and reliability of forex trading signals are paramount. ThinkMarkets ensures that its signals are generated from credible sources, including seasoned market analysts and advanced trading algorithms. This reliability is bolstered by regular updates and validations against market conditions.

Using Forex Trading Signals Effectively

Integration with Trading Strategy

Integrating signals into a trading strategy requires understanding the trader's specific goals and risk tolerance. Signals should complement a well-defined trading plan, not replace it. For instance, a trader focused on short-term movements might prioritize price action signals over long-term economic forecasts.

Risk Management

Proper risk management is critical when following trading signals. ThinkMarkets advises traders to use stop-loss orders and to manage their position sizes appropriately to mitigate potential losses. Understanding the risk associated with different types of signals can significantly affect trading outcomes.

Trends and Feedback in Forex Signals

Industry Trends

The forex market has seen a significant increase in the use of automated trading systems, including those that generate trading signals. As per a recent industry report, automated trading now accounts for a considerable portion of daily forex transactions. This trend highlights the growing reliance on efficient and accurate trading signals.

User Feedback

Feedback from users of ThinkMarkets indicates a high level of satisfaction with the accuracy and timeliness of the signals provided. Many traders appreciate the blend of technical and fundamental analysis, which allows for informed decision-making in various market conditions.

Conclusion

Forex trading signals are invaluable tools that, when used correctly, can enhance a trader's ability to make informed decisions in the forex market. ThinkMarkets provides a robust platform where traders can access reliable and timely signals. By understanding and appropriately integrating these signals into their trading strategies, traders can significantly improve their chances of success in the competitive world of forex trading.