In the rapidly evolving landscape of forex trading, selecting the right broker can significantly impact your trading success. HotForex, now rebranded as HF Markets, is a prominent name in the industry, known for its comprehensive service offerings and robust trading platforms. This review aims to provide a balanced look at the pros and cons of trading with HF Markets, helping both novice and experienced traders make informed decisions.

Pros of Trading with HF Markets

1. Regulatory Compliance and Safety

HF Markets boasts strong regulatory oversight, with licenses from several top-tier authorities, including the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This regulatory framework not only ensures operational transparency but also offers traders a level of security for their investments.

2. Diverse Trading Instruments

Traders at HF Markets have access to a wide range of trading instruments across forex, commodities, stocks, and indices. This diversity allows traders to explore different markets and strategies, enhancing their trading experience and potential for profitability.

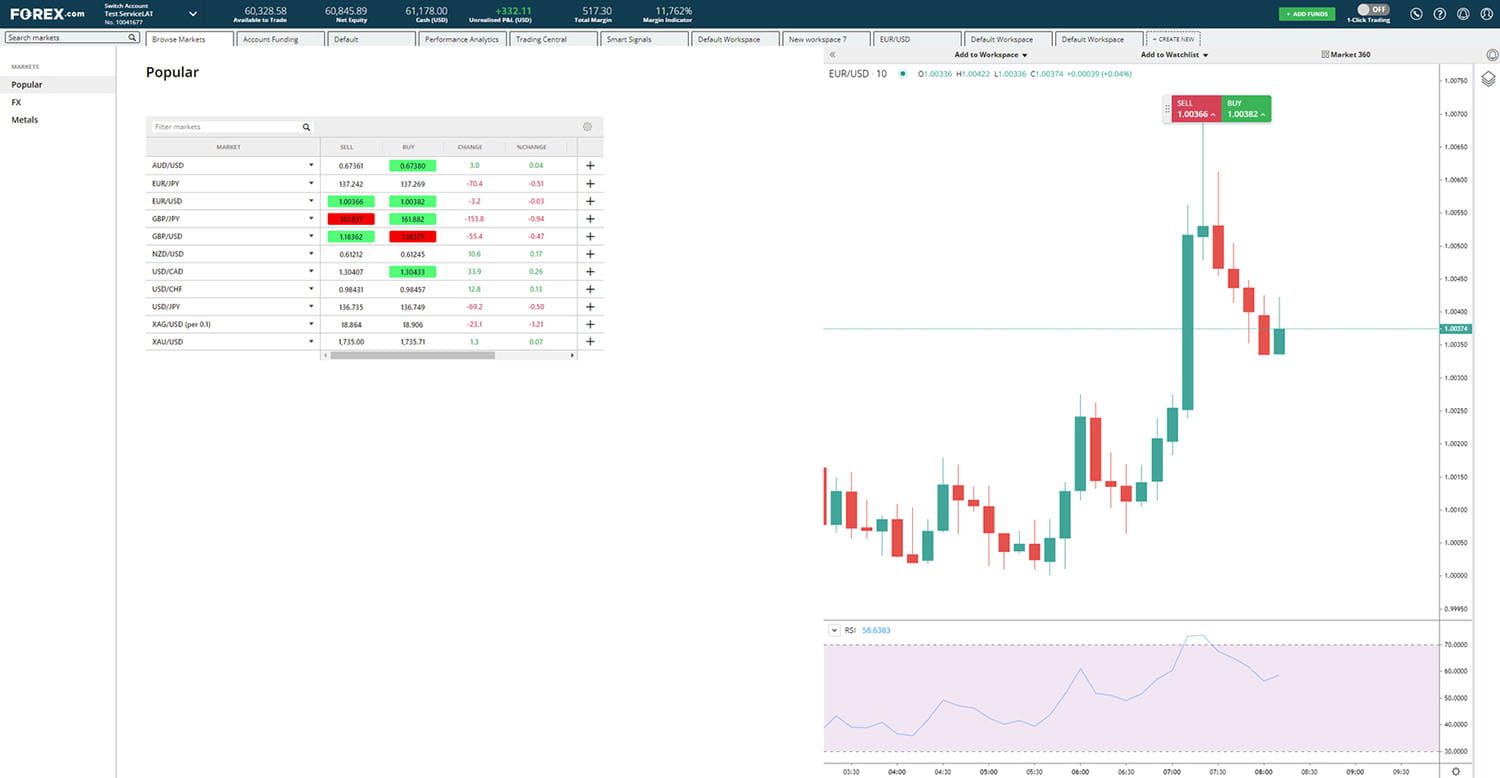

3. Advanced Trading Platforms and Tools

HF Markets offers the industry-standard MetaTrader 4 and MetaTrader 5 platforms, known for their reliability, user-friendly interfaces, and advanced trading features such as automated trading, comprehensive charting tools, and technical analysis capabilities. The availability of such tools is crucial for effective trading and strategy implementation.

4. Educational Resources and Customer Support

A key advantage of HF Markets is its extensive range of educational materials and responsive customer support. The broker provides numerous webinars, e-books, and a forex education center, all designed to support trader education and skill development. Additionally, their customer service is available 24/5 and has been highly rated for efficiency and helpfulness.

Cons of Trading with HF Markets

1. Trading Costs and Fees

While HF Markets offers competitive spreads, certain accounts are subject to higher than average trading costs, including commissions and swap fees. It's important for traders to carefully review the fee structure associated with their account type to ensure it aligns with their trading strategy and volume.

2. Geographic Restrictions

Despite its global presence, HF Markets does not accept clients from certain countries, including the USA, due to regulatory constraints. This limitation can be a significant drawback for traders residing in excluded regions who wish to utilize HF Markets’ services.

3. Platform Limitations

Although MetaTrader platforms are well-regarded in the industry, some traders may find them limiting if they seek more unique or advanced trading features that are only available on other platforms. This can deter traders who prefer a more customized or varied trading environment.

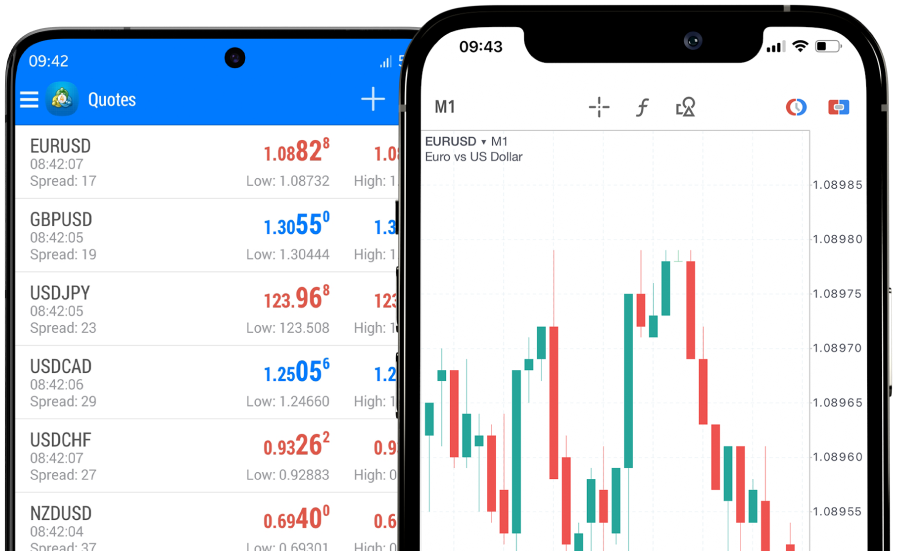

Industry Trends and Data

The forex industry has seen significant growth in technological integration, with an increasing emphasis on mobile trading and the use of artificial intelligence for trading analytics. HF Markets has incorporated these trends through its mobile trading capabilities and continuous platform upgrades, ensuring it remains competitive in a fast-paced market.

For further details on HF Markets’ regulatory status and company history, traders can refer to the Financial Conduct Authority’s official website.

Conclusion

HF Markets presents a robust trading platform with many benefits, including strong regulatory compliance, a wide range of trading instruments, and excellent educational resources. However, potential traders should also consider the cons, such as certain geographic restrictions and platform limitations. By weighing these factors, traders can better decide if HF Markets aligns with their trading needs and objectives.