In the ever-evolving landscape of Forex trading, choosing the right broker is crucial for both novice and seasoned traders. As we step into 2024, the comparison between TMGM and easyMarkets becomes increasingly relevant, given their prominence in the Forex trading sphere. This article aims to provide an in-depth analysis of these platforms, highlighting key features, regulatory compliance, user feedback, and industry trends to assist traders in making informed decisions.

Introduction

Forex trading platforms like TMGM and easyMarkets serve as gateways to the dynamic world of currency exchange. With the market's complexity and risks, the choice of broker can significantly impact trading success. This review meticulously compares TMGM and easyMarkets, focusing on their reliability, service quality, and offerings to present a balanced view for traders.

Regulatory Compliance and Security

TMGM: Regulated by several top-tier authorities, including ASIC and FCA, TMGM emphasizes security and adherence to financial regulations. Its global presence and compliance with strict regulatory standards assure traders of a secure trading environment.

easyMarkets: Similarly, easyMarkets is regulated by CySEC and ASIC, ensuring high levels of security and regulatory adherence. Its long-standing reputation since 2001 further solidifies its commitment to trader safety and regulatory compliance.

Both brokers demonstrate a strong commitment to security, although their regulatory jurisdictions may cater to different global audiences.

Trading Platforms and Tools

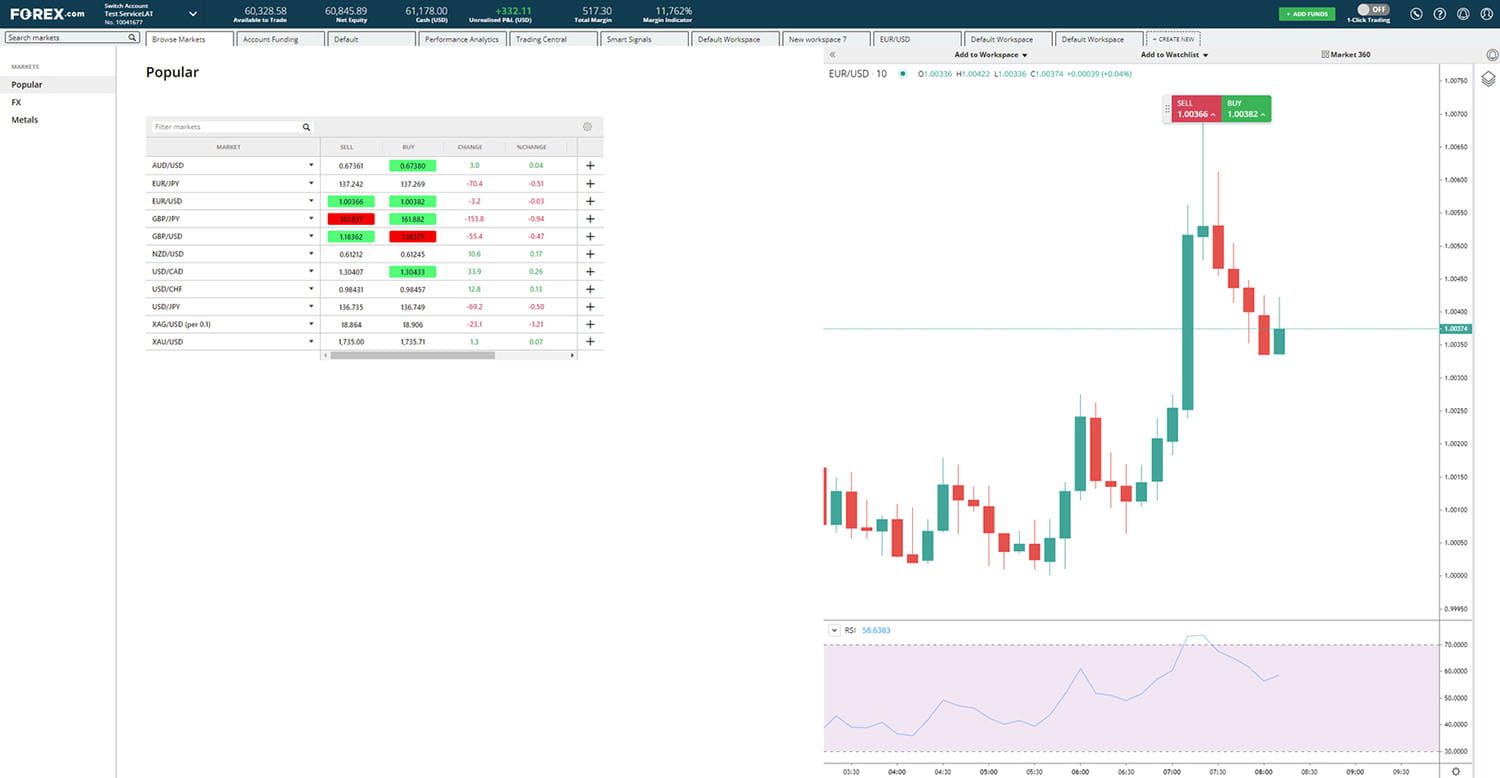

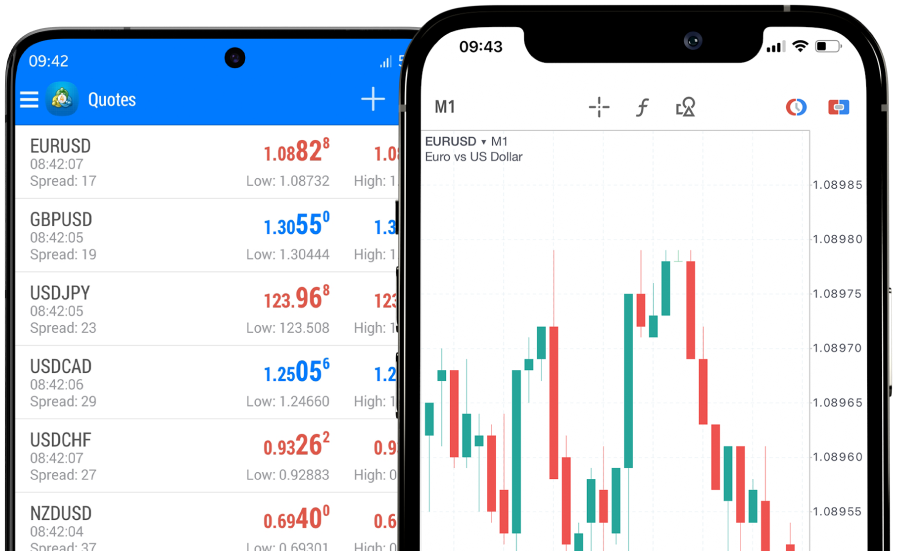

TMGM: Offers access to MetaTrader 4 and MetaTrader 5, renowned for their advanced trading tools and automated trading options. TMGM also provides IRESS for traders looking for a more diversified investment portfolio.

easyMarkets: Besides offering MetaTrader 4, easyMarkets features its proprietary platform that simplifies trading with tools like dealCancellation and Freeze Rate. This unique offering caters to traders seeking innovative risk management options.

The choice between TMGM and easyMarkets may come down to whether a trader prefers traditional platforms like MT4/MT5 or innovative, proprietary solutions.

Account Types, Spreads, and Fees

TMGM: Known for its competitive spreads and low commission structure, TMGM provides a transparent fee model. It offers various account types to suit different trading styles and levels of experience.

easyMarkets: Offers fixed spreads, which can be advantageous for traders who prefer predictable costs. easyMarkets also provides features like free guaranteed stop loss on its accounts, enhancing risk management for traders.

Comparing fees and account features requires traders to consider their trading style and preference for fixed vs. variable spreads.

Customer Support and Educational Resources

TMGM: Scores highly on customer support, offering multi-lingual services and a wealth of educational materials aimed at traders at all levels. Its commitment to trader education and support is evident through webinars, tutorials, and an extensive FAQ section.

easyMarkets: Also excels in customer service, providing comprehensive educational resources, including videos, eBooks, and articles. Its personalized training sessions and accessible support team ensure traders have the guidance they need.

Both brokers show a strong emphasis on education and support, although the depth and format of resources may appeal differently to individual preferences.

User Feedback and Industry Trends

Incorporating user feedback and industry trends, TMGM and easyMarkets both maintain generally positive reputations among traders. Notably, user testimonials highlight TMGM's advanced tools and competitive spreads, while easyMarkets is praised for its user-friendly platform and innovative trading features. Industry trends underscore the growing demand for brokers that combine technological innovation with user-centric services.

Conclusion

The choice between TMGM and easyMarkets in 2024 hinges on several factors, including regulatory compliance, platform preference, fee structures, and the value placed on educational resources. Both brokers offer distinct advantages: TMGM with its advanced tools and competitive pricing, and easyMarkets with its user-friendly interface and innovative risk management tools. Traders are encouraged to assess their individual needs, trading style, and preferences before making a decision.

In navigating the complexities of Forex trading, the importance of choosing a broker that aligns with one's trading goals and preferences cannot be overstated. By offering a detailed comparison of TMGM and easyMarkets, this review aims to equip traders with the knowledge to make informed choices, fostering a more secure and productive trading experience.