How to Use Signals in Your Strategy

In the fast-paced and ever-changing world of trading, signals play a pivotal role in helping traders make informed decisions and execute successful strategies. Whether you're a novice or an experienced trader, understanding how to effectively use signals within your strategy is crucial for navigating the complexities of the financial markets. In this article, we'll explore practical approaches to incorporating signals into your trading strategy for optimal results.

1. Choose Your Signal Wisely:

1.1 Source Reliability:

The first step in utilizing signals effectively is to choose a reliable source. Look for reputable signal providers with a proven track record of accuracy. Consider online reviews, user feedback, and any verified performance records to ensure the reliability of the source.

1.2 Align with Your Trading Style:

Signals should align with your trading style and preferences. If you are a day trader, focus on signals that cater to intraday movements. Long-term investors may look for signals that provide insights into broader market trends.

1.3 Diversify Signal Sources:

Diversification applies not only to your portfolio but also to your signal sources. Relying on signals from various providers, using different methodologies, can provide a more comprehensive view of the market and reduce dependency on a single source.

2. Understand the Signal's Context:

2.1 Analyze Market Conditions:

Before incorporating a signal into your strategy, analyze the current market conditions. Consider factors such as volatility, economic events, and global trends. Understanding the broader context ensures that the signal is applied in a relevant and timely manner.

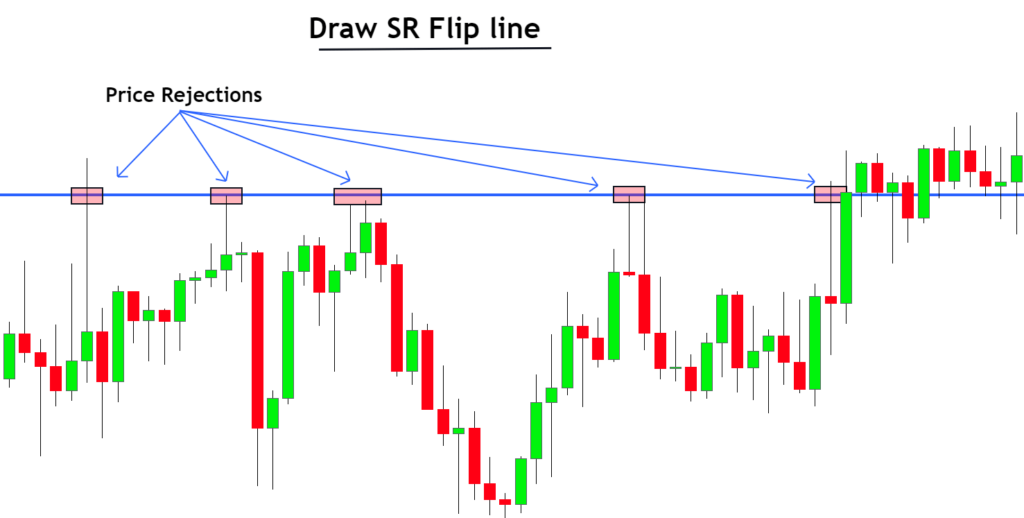

2.2 Correlate with Other Indicators:

Use signals in conjunction with other technical indicators. Confirming signals with additional indicators, such as moving averages, RSI, or MACD, can strengthen the validity of the trading decision. Look for convergence among multiple indicators for added confirmation.

3. Integration into Your Trading Plan:

3.1 Set Clear Objectives:

Define clear objectives for each trade based on the signals received. Establish your risk tolerance, profit targets, and the duration of the trade. A well-defined plan helps you stay disciplined and focused on your trading strategy.

3.2 Risk Management:

Integrate risk management into your trading plan. Set appropriate stop-loss levels and position sizes based on the signals' guidance. Effective risk management is essential for preserving capital and mitigating potential losses.

3.3 Backtest Your Strategy:

Backtesting involves applying historical data to test the effectiveness of your strategy. Apply signals to past market conditions to assess how well they would have performed. Backtesting helps identify the strengths and weaknesses of your strategy.

4. Monitor and Adapt:

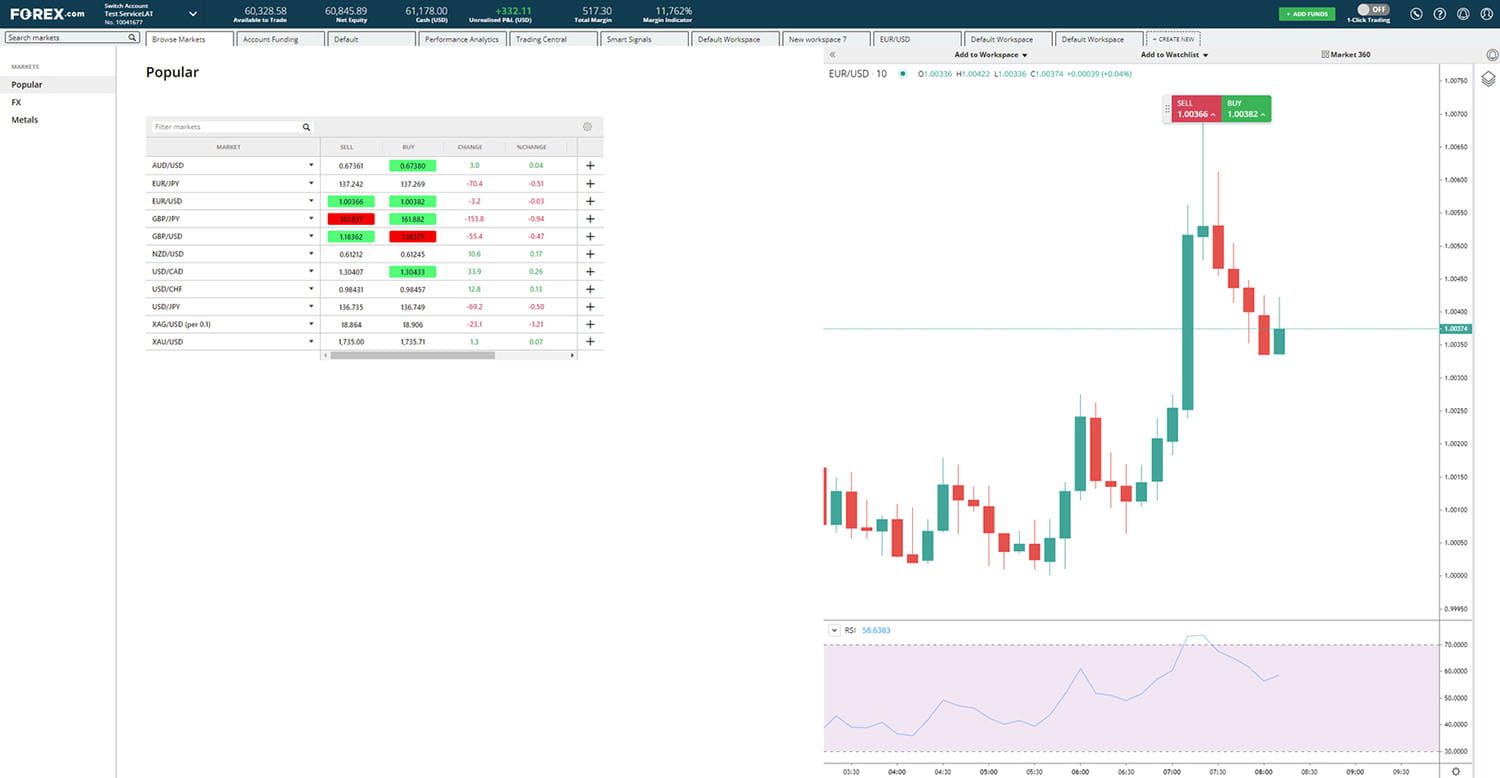

4.1 Real-Time Monitoring:

Stay vigilant and monitor the markets in real-time. The financial landscape is dynamic, and adjustments may be needed based on emerging trends or unexpected events. Regularly assess the ongoing validity of the signals within the context of the current market environment.

4.2 Adaptability:

Be adaptable in response to changing market conditions. If signals indicate a shift in trend or volatility, be prepared to adjust your strategy accordingly. A rigid approach may lead to missed opportunities or increased risks.

5. Continuous Learning:

5.1 Evaluate Performance:

Regularly evaluate the performance of signals within your strategy. Assess the accuracy of past signals, analyze your trading outcomes, and identify areas for improvement. Continuous learning is key to refining and optimizing your trading approach.

5.2 Stay Informed:

Stay informed about market news, economic indicators, and geopolitical events. External factors can influence market movements and impact the effectiveness of signals. Being aware of these factors enhances your ability to interpret signals within the broader market context.

Conclusion:

Effectively incorporating signals into your trading strategy requires a combination of careful selection, understanding market context, and disciplined execution. By choosing reliable sources, adapting to changing market conditions, and continuously evaluating and learning from your experiences, you can enhance the success of your trading strategy.