Finding the best Forex trading signals can significantly enhance a trader's success in the foreign exchange market. These signals provide valuable insights into market trends, potential trade opportunities, and optimal entry and exit points. This guide explores the key factors to consider when searching for the best Forex trading signals, including types of signals, sources, reliability, performance, and user feedback.

Introduction

Forex trading signals are essential tools for traders looking to make informed decisions in the dynamic Forex market. With a multitude of signal providers available, finding the best signals can be challenging. However, by understanding the key factors that define high-quality signals, traders can effectively evaluate and select the best signals for their trading needs.

Types of Forex Trading Signals

1. Manual Signals

Manual signals are generated by human analysts who analyze market conditions and trends. These signals are based on expert analysis and are often considered more reliable.

2. Automated Signals

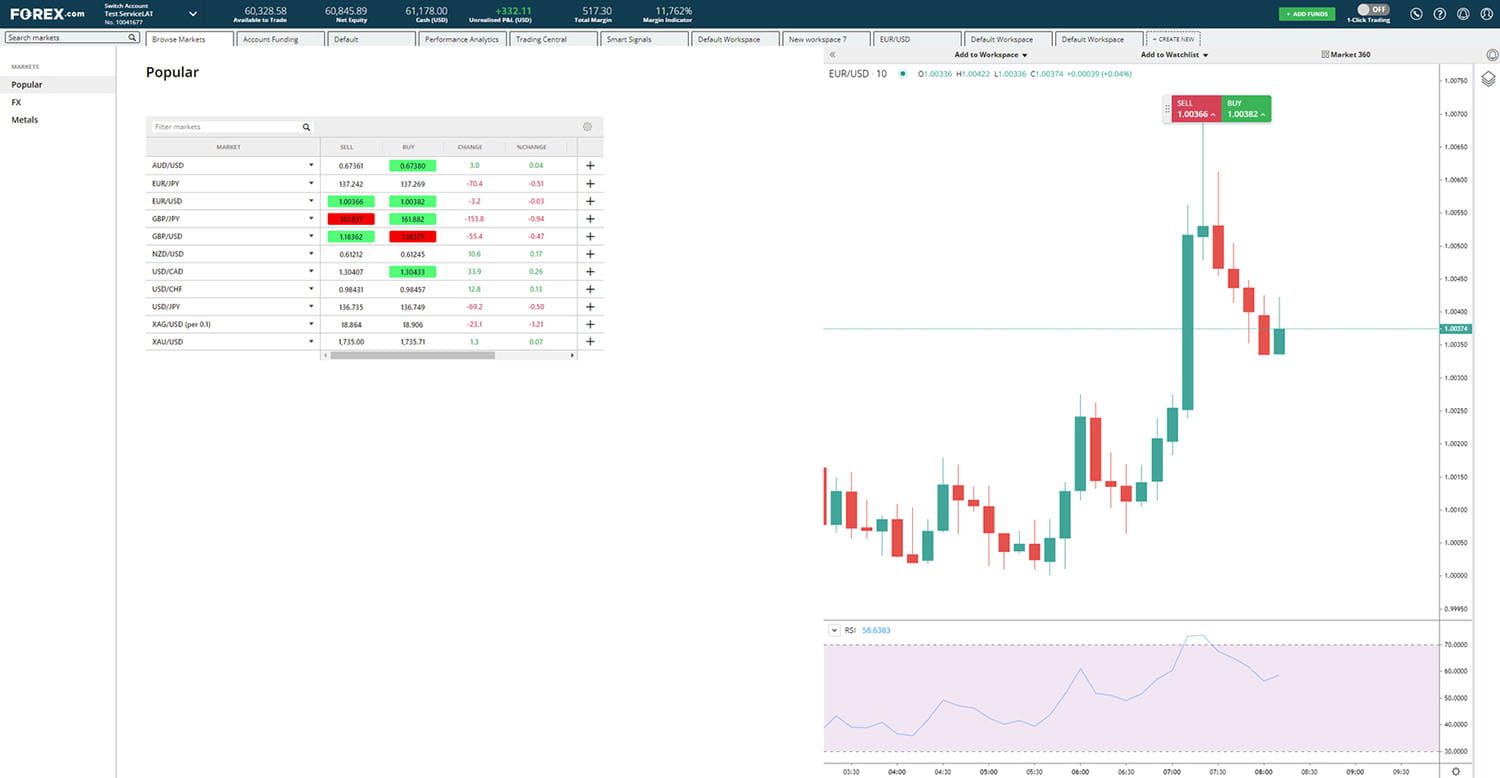

Automated signals are generated by algorithms that analyze market data and technical indicators. These signals are objective and free from human emotions, providing a systematic approach to trading.

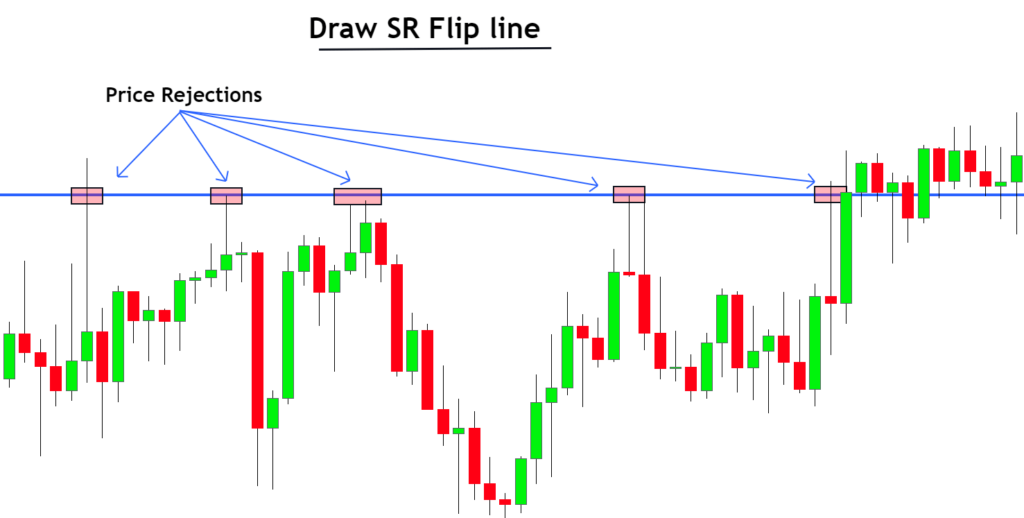

3. Technical Analysis Signals

Technical analysis signals are based on the study of price charts and technical indicators. Traders use tools like moving averages, MACD, and RSI to identify patterns and trends.

4. Fundamental Analysis Signals

Fundamental analysis signals are based on economic news and events that affect currency prices. Traders analyze factors such as interest rates, GDP, and geopolitical events to make trading decisions.

5. Sentiment Analysis Signals

Sentiment analysis signals gauge market sentiment or the mood of traders. These signals are based on data from social media, news articles, and trading forums.

Factors to Consider When Evaluating Forex Trading Signals

1. Reliability of Signals

The reliability of signals is crucial, as traders need to trust that the signals accurately reflect market conditions. Look for providers with a proven track record of delivering reliable signals.

2. Performance History

Evaluate the performance history of the signal provider to assess their track record. Look for providers with consistent and profitable signals over a sustained period.

3. Transparency

Transparency is key when evaluating signal providers. Look for providers who are transparent about their trading strategies, signal generation process, and performance metrics.

4. Risk Management

Consider the risk management practices of the signal provider. Look for providers who prioritize risk management and provide clear guidelines on managing risk.

5. User Feedback

User feedback can provide valuable insights into the quality of signals. Look for providers with positive user feedback and testimonials from satisfied customers.

Industry Trends and Statistics

1. Growth in Signal Services

The demand for signal services is on the rise, with many traders relying on signals to make trading decisions. This trend is driven by the desire for accurate and timely market insights.

2. Increased Reliance on Automated Signals

Automated signals are becoming increasingly popular, as they offer a systematic approach to trading. Many traders prefer automated signals for their objectivity and efficiency.

3. Importance of Signal Quality

As the Forex market becomes more competitive, the quality of signals is becoming increasingly important. Traders are seeking high-quality signals that provide accurate and timely market insights.

User Feedback and Case Studies

1. Positive User Experiences

Many traders report positive experiences with Forex trading signals, citing their role in improving trading outcomes. Users appreciate the convenience and reliability of signals.

2. Case Study: Blueberry Markets

Blueberry Markets is a reputable Forex broker known for its reliable trading signals. The broker offers a range of signal services, including manual and automated signals, to cater to different trading styles and preferences. Traders who have used Blueberry Markets' signals praise their accuracy and effectiveness in identifying profitable trading opportunities.

Conclusion

Finding the best Forex trading signals requires careful evaluation of various factors, including the type of signals, sources, reliability, performance, and user feedback. By considering these factors, traders can identify high-quality signals that enhance their trading strategies and outcomes. Blueberry Markets is a prime example of a broker that provides reliable and effective trading signals, making it a top choice for traders looking to improve their trading performance.