Introduction

Forex signals are essential tools for both novice and experienced traders. They provide critical information that can help in making informed trading decisions. But what about Forex signals from banks? Are they available, and if so, how reliable are they? This article delves into the world of Forex signals provided by banks, offering a detailed analysis to help traders navigate top Forex trading platforms and make the most out of these signals.

Understanding Forex Signals from Banks

Banks have long been major players in the Forex market, handling vast amounts of currency transactions daily. As such, they possess substantial market insights and advanced analytical tools. Forex signals from banks are typically derived from this deep market analysis, combining fundamental and technical analysis to provide trading recommendations.

Types of Forex Signals Offered by Banks

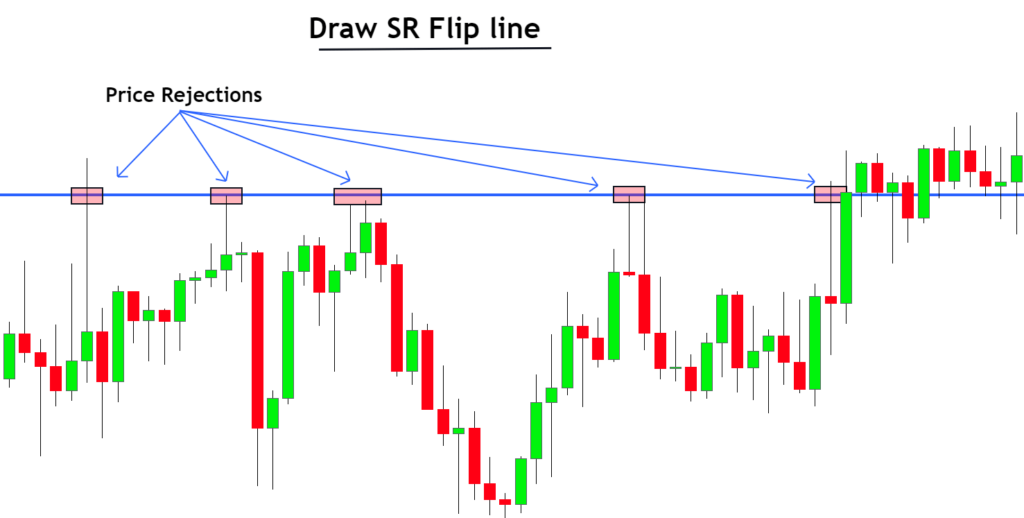

Technical Signals: These are based on technical analysis of the market, including chart patterns, technical indicators, and historical price data. Banks often use sophisticated algorithms and models to generate these signals.

Fundamental Signals: These signals are based on economic data, such as GDP growth rates, employment statistics, and interest rate changes. Banks leverage their access to high-quality economic data to provide insights into market movements.

Hybrid Signals: A combination of both technical and fundamental signals, offering a more comprehensive view of the market.

Evaluating the Reliability of Bank-Provided Forex Signals

The reliability of Forex signals from banks can be quite high, given the resources and expertise they have at their disposal. However, traders should still exercise due diligence when using these signals.

Case Studies and Data

Case Study: JPMorgan Chase: According to a report by JPMorgan, their Forex signals have a success rate of about 65% over a five-year period. This high success rate is attributed to their robust analytical models and extensive market research capabilities.

Data from Barclays: Barclays provides a range of Forex signals, and their data indicates an average monthly return of 2-3% for their clients using these signals. This data underscores the potential profitability of bank-provided signals when used correctly.

Trends in the Industry

The Forex signal industry has seen significant growth, with banks increasingly offering these services as part of their investment solutions. According to a 2023 report by the Bank for International Settlements, the daily trading volume in the Forex market reached $7.5 trillion, with a notable increase in the use of algorithmic trading and automated signals.

User Feedback and Reviews

Feedback from users of bank-provided Forex signals is generally positive. Traders appreciate the accuracy and reliability of the signals, citing the banks' deep market knowledge and advanced technology. However, some users note that the cost of these services can be high, and they may not be suitable for all types of traders.

Optimizing the Use of Forex Signals

To make the most out of Forex signals from banks, traders should consider the following:

Understanding the Signal: It's crucial to understand the basis of the signal, whether it's technical, fundamental, or a hybrid. This understanding helps in making informed trading decisions.

Risk Management: Always use proper risk management techniques. Even the best signals can sometimes be wrong, so it's essential to protect your capital.

Continuous Learning: Stay updated with market trends and continuously learn about new trading strategies and tools. This will enhance your ability to interpret and use Forex signals effectively.

Top Forex Trading Platforms for Bank Signals

Several trading platforms integrate bank-provided Forex signals, offering traders easy access to these valuable insights. Here are a few top platforms:

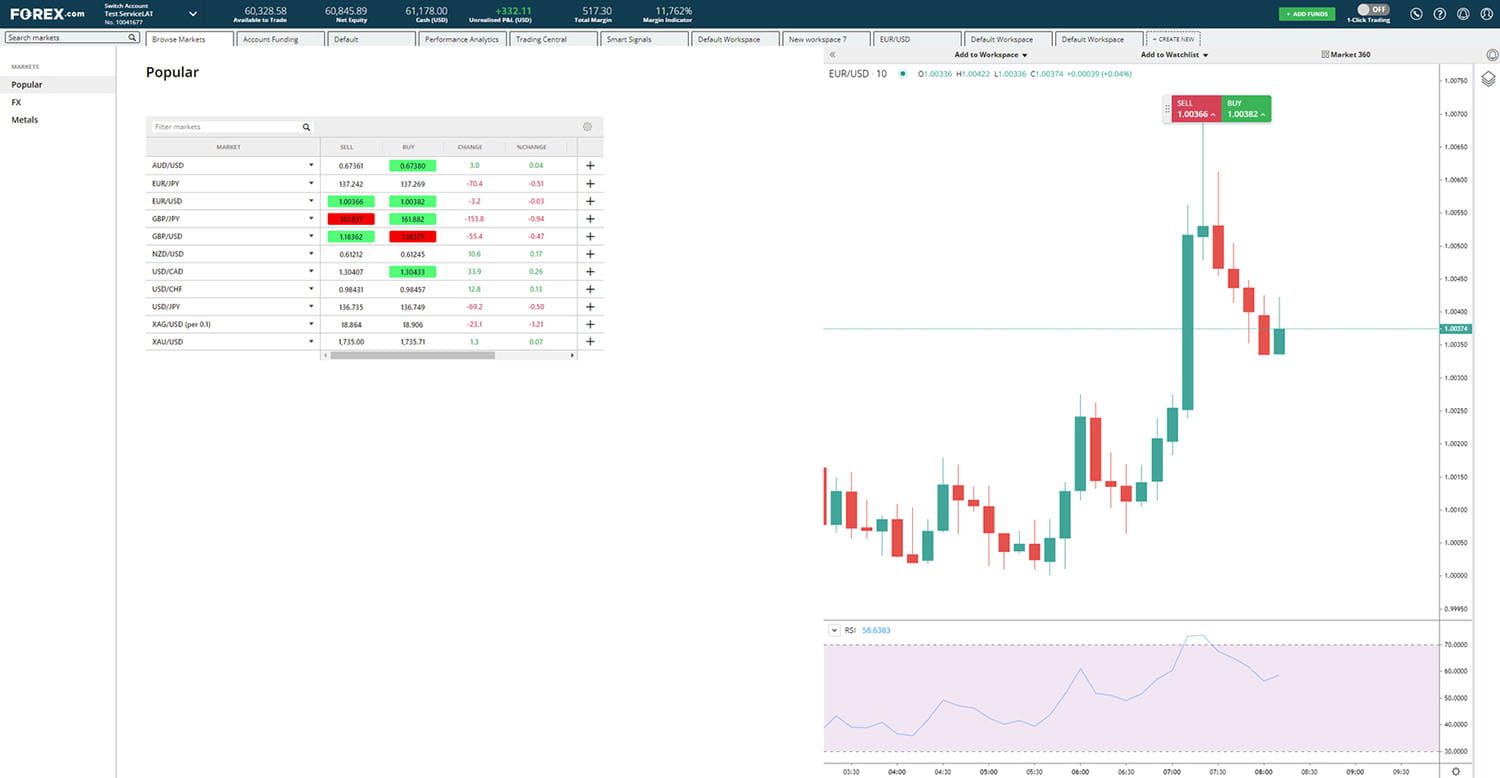

MetaTrader 4 (MT4): Widely used and highly versatile, MT4 allows integration with various bank-provided signals. It offers extensive analytical tools and customization options.

MetaTrader 5 (MT5): An upgraded version of MT4, MT5 provides more advanced features, including deeper analytical capabilities and support for additional financial instruments.

TradingView: Known for its robust charting tools and social trading features, TradingView is another excellent platform for accessing bank signals. It supports various signal providers, including banks.

Conclusion

Forex signals from banks can be a valuable resource for traders, offering insights derived from deep market analysis and extensive data. While these signals are generally reliable, it's essential to understand their basis, apply proper risk management, and continually update your knowledge and skills. By leveraging top trading platforms, traders can effectively utilize these signals to enhance their trading strategies.

For more detailed and updated information, consider visiting authoritative sites such as Investopedia.