1-2 Daily Nas100 Signals

The Nasdaq-100, commonly referred to as Nas100, represents the performance of the top 100 non-financial companies listed on the Nasdaq stock exchange. Traders and investors often seek signals to navigate the dynamics of Nas100, aiming to capitalize on potential price movements. In this article, we explore the concept of receiving 1-2 daily Nas100 signals, examining the significance, strategies, and considerations for traders in this fast-paced market.

1. Significance of Daily Nas100 Signals:

1.1 Real-Time Decision Making:

The Nas100 is known for its rapid movements, driven by technology and high-growth stocks. Daily signals provide traders with real-time information, enabling prompt decision-making to capture potential opportunities or mitigate risks.

1.2 Efficient Portfolio Management:

For active traders managing a portfolio with exposure to Nas100, daily signals assist in making timely adjustments. Whether it's rebalancing the portfolio or adjusting positions, having 1-2 signals daily ensures efficiency in portfolio management.

1.3 Capitalizing on Intraday Trends:

Intraday trends in Nas100 can be substantial. Daily signals cater to traders looking to capitalize on these short-term movements, allowing for strategic entries and exits within the trading day.

2. Strategies for Utilizing Daily Nas100 Signals:

2.1 Trend Following:

Utilize daily signals to identify and follow prevailing trends in Nas100. Traders can align their positions with the overall trend, entering long positions during uptrends and short positions during downtrends.

2.2 Intraday Scalping:

For traders seeking quick profits within the daily fluctuations of Nas100, intraday scalping strategies can be effective. Daily signals help identify potential entry and exit points for short-term trades.

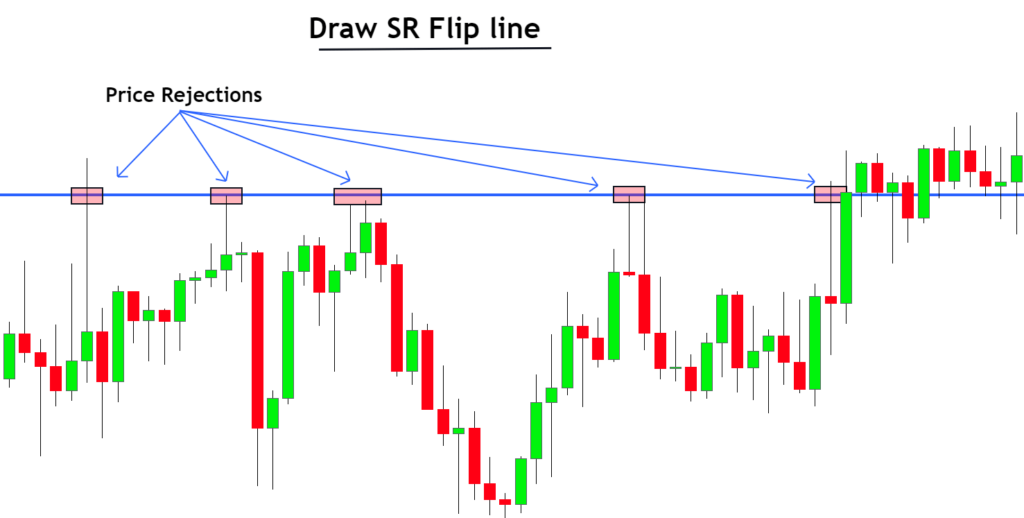

2.3 Support and Resistance Trading:

Incorporate daily Nas100 signals into support and resistance trading strategies. Identify key levels based on the signals and execute trades accordingly, taking advantage of price bounces or breakouts.

2.4 Risk Management:

Daily signals play a crucial role in risk management. Traders can use the signals to set appropriate stop-loss and take-profit levels, ensuring disciplined and controlled trading.

3. Considerations for Traders:

3.1 Source Reliability:

Ensure the reliability of the source providing daily Nas100 signals. Choose reputable signal providers with a track record of accuracy and transparent performance data.

3.2 Compatibility with Trading Style:

Consider the compatibility of daily Nas100 signals with your trading style. Different traders have varying risk tolerance levels and preferences, so select signals that align with your individual approach.

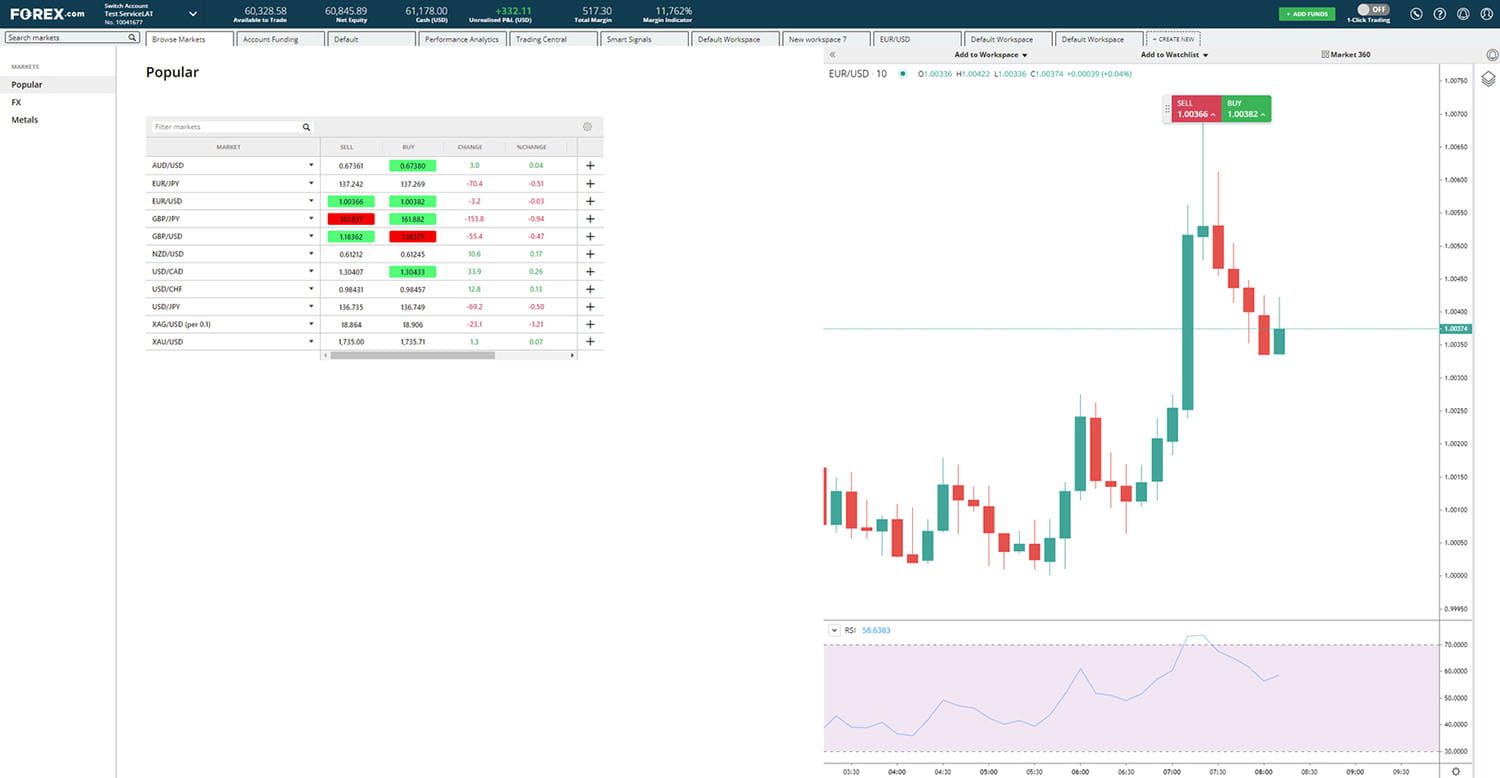

3.3 Real-Time Communication:

Opt for signal services that offer real-time communication of daily Nas100 signals. Timely updates are crucial in the fast-paced Nasdaq market, allowing traders to act swiftly on emerging opportunities.

3.4 Backtesting and Verification:

Prior to fully relying on daily Nas100 signals, conduct backtesting to verify the historical performance of the signals. This empirical analysis helps in assessing the effectiveness of the signals under different market conditions.

4. Risk and Reward Dynamics:

4.1 Risk Management Strategies:

Incorporate robust risk management strategies when trading with daily Nas100 signals. Determine appropriate position sizes, set stop-loss levels, and diversify your portfolio to manage potential risks effectively.

4.2 Reward Potential:

Evaluate the reward potential associated with daily Nas100 signals. Assess the risk-to-reward ratio for each trade, ensuring that potential profits justify the assumed risks.

Conclusion:

In the dynamic world of Nasdaq-100 trading, receiving 1-2 daily signals provides traders with a valuable tool for navigating the market. By adopting suitable strategies, considering essential factors, and managing risk effectively, traders can capitalize on the potential opportunities offered by daily Nas100 signals.